Beginning with term life insurance rates, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Term life insurance rates are a crucial aspect of financial planning, impacting individuals and families in various ways. Understanding the intricacies of these rates can lead to informed decisions and secure futures.

Overview of Term Life Insurance Rates

Term life insurance is a type of life insurance that provides coverage for a specific period of time, known as the term. Term life insurance rates refer to the amount of money policyholders pay to the insurance company in exchange for coverage during the term.

How Term Life Insurance Rates are Determined

Term life insurance rates are determined based on several factors that assess the risk associated with insuring an individual. These factors include:

- The age of the policyholder: Younger individuals typically pay lower rates as they are considered lower risk.

- The term length: Longer terms usually result in higher rates.

- Health condition: Policyholders with pre-existing health conditions may pay higher rates.

- Lifestyle habits: Factors like smoking or engaging in risky activities can impact rates.

- Coverage amount: Higher coverage amounts result in higher rates.

Factors Affecting Term Life Insurance Rates

When it comes to determining term life insurance rates, several factors come into play that can significantly impact the cost of coverage. Understanding these factors is crucial for individuals looking to secure the right policy at an affordable rate.

Age

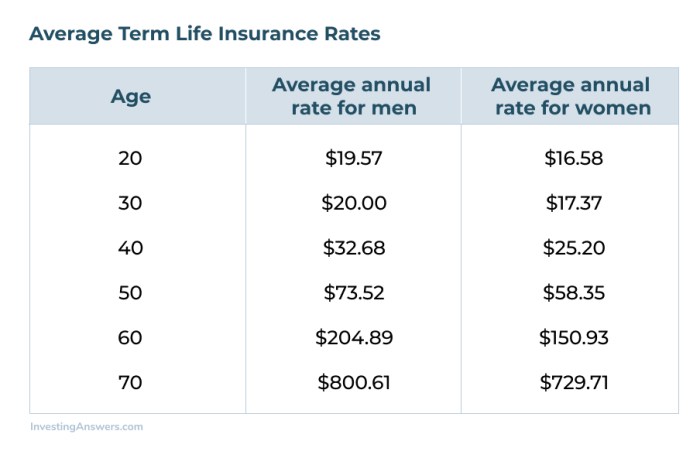

Age is one of the most influential factors in determining term life insurance rates. Typically, younger individuals are offered lower premiums compared to older individuals. This is because younger policyholders are considered less risky to insure, as they are statistically less likely to pass away during the policy term.

As individuals age, the risk of developing health issues or passing away increases, leading to higher premiums for older applicants.

Health and Lifestyle Choices

Health and lifestyle choices also play a critical role in determining term life insurance rates. Insurance companies assess an individual's overall health, including pre-existing medical conditions, current health status, and lifestyle habits such as smoking, alcohol consumption, and participation in high-risk activities.

Healthier individuals who lead a low-risk lifestyle are typically offered lower premiums, as they are less likely to make claims during the policy term. On the other hand, individuals with existing health issues or engaging in risky behaviors may face higher premiums to compensate for the increased risk they pose to the insurance company.

Comparison of Term Life Insurance Rates

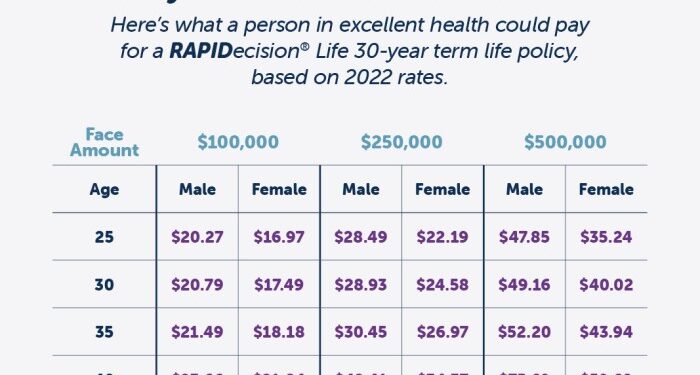

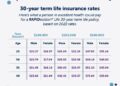

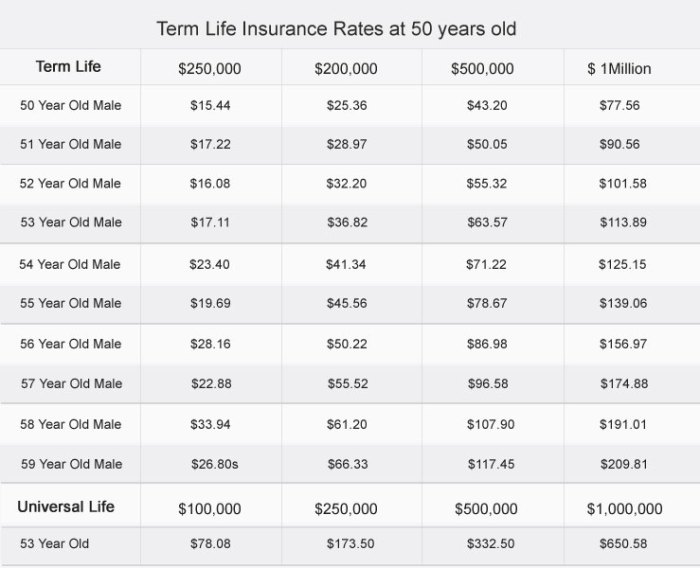

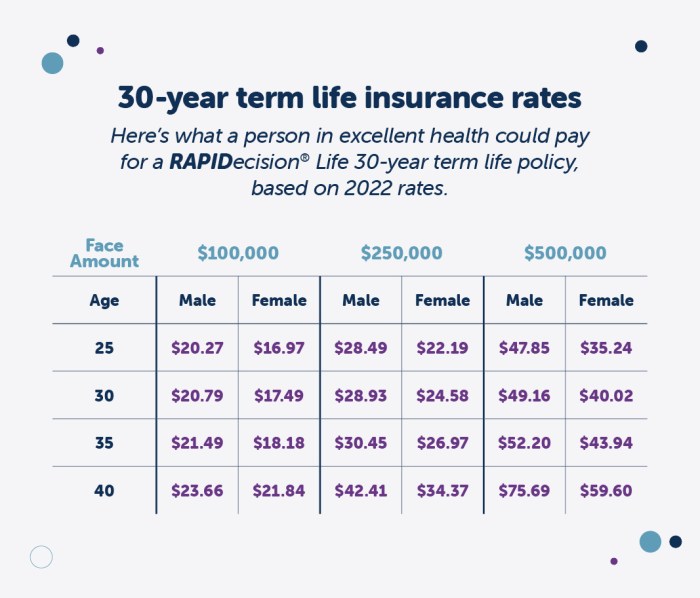

When comparing term life insurance rates, it is essential to consider various factors that can affect the cost. Providers offer different rates based on coverage amount, term length, and age group. Understanding these differences can help you make an informed decision when selecting a policy.

Varying Rates Based on Coverage Amount and Term Length

- Insurance rates typically increase with higher coverage amounts. For example, a $500,000 policy will have a higher premium than a $250,000 policy.

- The term length of the policy also impacts the rates. Shorter terms, such as 10 years, generally have lower premiums compared to longer terms like 30 years.

- Providers may offer discounts for bundling coverage amounts or extending the term length, so it's worth exploring these options to find the best rate.

Differences in Rates Between Age Groups

- Youthful individuals generally receive lower rates compared to older individuals due to the lower risk of mortality at a younger age.

- As individuals age, the premiums for term life insurance tend to increase, especially as they enter higher age brackets.

- Providers may offer specific age-based pricing structures, so it's crucial to compare rates across different age groups to determine the most cost-effective option.

Understanding Term Life Insurance Rate Structures

When it comes to term life insurance, understanding the rate structures is crucial in order to make informed decisions about your coverage. There are various types of term life insurance rates, each with its own unique features and benefits.

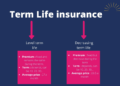

Difference between Level Term and Decreasing Term Insurance Rates

Level term insurance rates remain constant throughout the term of the policy, providing a predictable premium amount for the duration of coverage. On the other hand, decreasing term insurance rates decrease over time, typically aligning with a decreasing financial obligation as the policyholder ages.

How Annual Renewable Term Rates Work

Annual renewable term rates are renewed on a yearly basis, with the premium amount adjusted each year based on the policyholder's age and other factors. While these rates may start lower than level term rates, they can increase significantly as the policyholder ages.

Examples of How Term Life Insurance Rates Can Change Over Time

- At the beginning of a term life insurance policy, rates are typically lower for younger individuals who are considered lower risk for insurance companies.

- As the policyholder ages, rates may increase due to higher risk factors associated with older age, such as health issues or mortality risks.

- Factors like lifestyle changes, medical history, and coverage amount can also impact how term life insurance rates change over time.

Wrap-Up

In conclusion, term life insurance rates play a significant role in shaping financial security and peace of mind. By grasping the factors that influence these rates and comparing options across providers, individuals can make well-informed choices to protect their loved ones and assets.

FAQ Guide

What factors impact term life insurance rates?

Term life insurance rates are influenced by factors such as age, health, lifestyle choices, coverage amount, and term length. Each of these elements plays a crucial role in determining the final rate.

What is the difference between level term and decreasing term insurance rates?

Level term insurance rates remain constant throughout the policy term, providing a consistent premium. Decreasing term insurance rates, on the other hand, decrease over time as the coverage amount reduces.

How do annual renewable term rates work?

Annual renewable term rates are renewable every year but may increase as the policyholder ages. These rates offer flexibility but can lead to higher premiums over time.

Can term life insurance rates change over time?

Yes, term life insurance rates can change over time, especially with certain policies like annual renewable term insurance. It's essential to review your policy regularly to ensure it aligns with your current needs.