Delve into the world of term life insurance quotes as we uncover the essentials in a way that is both informative and engaging. From understanding the importance to deciphering the details, this guide has you covered.

Learn how to navigate the complexities of term life insurance quotes with ease and make informed decisions for your financial security.

Overview of Term Life Insurance Quote

A term life insurance quote is an estimate of the cost of purchasing a term life insurance policy for a specific period of time, usually ranging from 10 to 30 years. It provides information on the premium amount the policyholder would need to pay to secure coverage for a set term.

Getting a term life insurance quote is important as it helps individuals understand the potential cost of obtaining life insurance coverage for a certain period. By receiving quotes from different insurance providers, individuals can compare prices and coverage options to make an informed decision that aligns with their financial goals and needs.

Examples of Situations Requiring a Term Life Insurance Quote

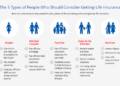

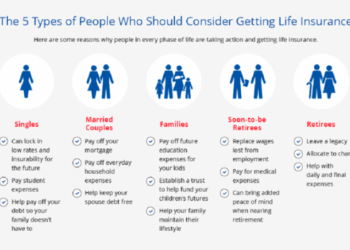

- Young parents who want to ensure financial protection for their children in case of unexpected events.

- Individuals with outstanding loans or mortgages who want to make sure their debts are covered if something happens to them.

- Business owners who need a financial safety net to protect their company and employees in case of their untimely passing.

- Retirees who want to leave a financial legacy for their loved ones or cover end-of-life expenses.

Factors Influencing Term Life Insurance Quotes

When insurance companies provide a term life insurance quote, they consider various factors that can impact the cost of the policy. Factors such as age, health, occupation, and lifestyle choices play a crucial role in determining the final quote for term life insurance.

Age

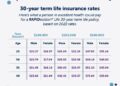

Age is a significant factor that influences term life insurance quotes. Younger individuals typically receive lower quotes compared to older individuals. This is because younger individuals are considered to be at a lower risk of developing health issues or passing away during the term of the policy.

Health

The health of the individual applying for term life insurance is another crucial factor. Insurance companies will assess the applicant's overall health, including any pre-existing conditions or lifestyle habits that may impact their longevity. Individuals with excellent health are likely to receive lower insurance quotes compared to those with health issues.

Occupation

The occupation of the individual can also impact the cost of a term life insurance quote. Risky or hazardous occupations may result in higher insurance quotes due to the increased likelihood of workplace accidents or health issues related to the job.

On the other hand, individuals with low-risk occupations may receive more affordable insurance quotes.

Lifestyle Choices

Lifestyle choices such as smoking, excessive drinking, or engaging in dangerous activities can also influence term life insurance quotes. Individuals with unhealthy lifestyle habits are considered to be at a higher risk of health issues or premature death, leading to higher insurance quotes.

Making positive lifestyle changes can help in reducing the cost of term life insurance.

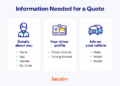

Obtaining a Term Life Insurance Quote

When it comes to obtaining a term life insurance quote, the process is relatively straightforward but requires attention to detail. Insurance providers typically require specific information to generate an accurate quote tailored to an individual's needs and circumstances.To request a term life insurance quote, individuals need to provide essential information such as their age, gender, occupation, health status, lifestyle habits, and desired coverage amount and term.

Additionally, details about any pre-existing medical conditions, family medical history, and whether or not the individual is a smoker are crucial factors that can affect the quote.

Importance of Comparing Multiple Term Life Insurance Quotes

When considering term life insurance, it is vital to compare quotes from multiple insurance providers before making a decision. By obtaining and comparing different quotes, individuals can ensure they are getting the best coverage at the most competitive rates available in the market

- Comparing multiple quotes allows individuals to evaluate the various coverage options, including term lengths and coverage amounts, offered by different insurance companies.

- It helps individuals understand the differences in premium costs and any additional benefits or riders that may be included in the policy.

- By comparing quotes, individuals can make an informed decision based on their budget and specific insurance needs, ensuring they select a policy that provides adequate coverage at a reasonable price.

- Furthermore, comparing quotes can help individuals identify any discrepancies or inconsistencies in the information provided, leading to a more accurate quote and avoiding potential issues during the policy application process.

Understanding Term Life Insurance Quote Details

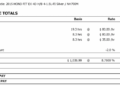

When looking at a term life insurance quote, it's essential to understand the various components that make up the overall value of the policy. These components include the coverage amount, premium, term length, and any additional riders that may be included in the policy.

Coverage Amount

The coverage amount refers to the sum of money that will be paid out to the beneficiary upon the policyholder's death. It is crucial to select a coverage amount that adequately meets the financial needs of your loved ones in the event of your passing.

Consider factors such as outstanding debts, future expenses, and income replacement when determining the appropriate coverage amount.

Premium

The premium is the amount you pay periodically to keep the policy active. It is essential to understand how the premium is calculated based on factors such as age, health, lifestyle, and coverage amount. Compare premiums from different insurance providers to ensure you are getting the best value for your money.

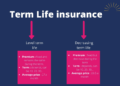

Term Length

The term length of a term life insurance policy refers to the duration for which the coverage is in effect. Common term lengths include 10, 20, or 30 years. It is important to choose a term length that aligns with your financial goals and obligations.

Consider factors such as the age of your dependents and the time needed to pay off debts when selecting a term length.

Riders

Riders are additional provisions that can be added to a term life insurance policy to customize coverage. Common riders include accelerated death benefit riders, waiver of premium riders, and accidental death benefit riders. Evaluate the riders offered by different insurance providers to determine which ones are beneficial for your specific needs.By understanding these components of a term life insurance quote and how they impact the overall value of the policy, you can make an informed decision when comparing and analyzing different quotes effectively.

Outcome Summary

In conclusion, term life insurance quotes play a crucial role in securing your loved ones' future. By grasping the nuances of the process and factors involved, you can confidently choose the best option tailored to your needs.

Q&A

What information do I need to provide to get a term life insurance quote?

To get a quote, you typically need to provide details like age, health history, lifestyle choices, and the coverage amount you're looking for.

Why is it important to compare multiple term life insurance quotes?

Comparing quotes allows you to find the best coverage at the most competitive price, ensuring you make an informed decision that suits your needs.

How do factors like health and occupation impact term life insurance quotes?

Health and occupation can influence the cost of your premium. For instance, risky jobs or health conditions may result in higher quotes.