Delving into the realm of life insurance quotes, this guide aims to shed light on the intricacies of this vital financial tool. From unraveling the basics to exploring the nuances of different policies, embark on a journey that demystifies the world of life insurance quotes.

With a plethora of information at your fingertips, navigating the realm of life insurance quotes has never been more accessible and enlightening.

Understanding Life Insurance Quotes

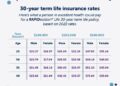

Life insurance quotes are estimates provided by insurance companies that detail the cost of a life insurance policy based on the individual's age, health, lifestyle, and coverage needs. These quotes can vary widely depending on the factors specific to the person seeking coverage.Obtaining life insurance quotes is crucial as it allows individuals to compare different policies and premiums to find the most suitable option for their needs.

By getting multiple quotes, individuals can ensure they are getting the best coverage at the most affordable rate.

Factors Influencing Life Insurance Quotes

- Age: Younger individuals typically receive lower quotes compared to older individuals due to the lower risk of mortality.

- Health: Individuals in good health are likely to receive lower quotes than those with pre-existing medical conditions.

- Occupation: Riskier occupations may lead to higher insurance quotes due to the increased likelihood of accidents or health issues.

- Lifestyle habits: Smokers or individuals with risky lifestyle habits may receive higher quotes due to the increased health risks associated with these behaviors.

- Coverage amount: The higher the coverage amount, the higher the insurance premium is likely to be.

Factors Influencing Life Insurance Quotes

When obtaining a life insurance quote, there are several key factors that insurance companies consider before determining the cost. These factors play a crucial role in assessing the risk associated with insuring an individual and ultimately impact the final premium amount.

Age

Age is one of the primary factors that influence life insurance quotes. Younger individuals typically receive lower premiums as they are considered to be at a lower risk of developing health issues or passing away prematurely. As individuals age, the likelihood of health complications increases, resulting in higher insurance costs.

Health

The health status of an individual is another significant factor in determining life insurance quotes. Insurance companies assess the applicant's overall health, medical history, and any pre-existing conditions to evaluate the level of risk. Those with existing health issues may face higher premiums or even potential denial of coverage.

Lifestyle

An individual's lifestyle choices can also impact life insurance quotes. Factors such as smoking, alcohol consumption, participation in high-risk activities, and occupation can influence the premium amount. Risky behaviors are associated with a higher likelihood of premature death, leading to increased insurance costs.

Coverage Amount

The coverage amount selected by an individual directly affects the life insurance quote. Higher coverage amounts result in higher premiums, as the insurance company will need to pay out a larger sum in the event of the policyholder's death. It is essential to strike a balance between adequate coverage and affordability when choosing a policy.

Comparison of Insurance Companies

Different insurance companies may use varying criteria and algorithms to calculate life insurance quotes. While the key factors such as age, health, lifestyle, and coverage amount remain consistent, the weight assigned to each factor can differ. It is advisable to obtain quotes from multiple insurers to compare prices and coverage options effectively.

Types of Life Insurance Policies

When it comes to life insurance, there are two main types of policies: term life insurance and whole life insurance. Each type has its own features and benefits, making them suitable for different situations.

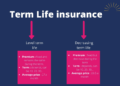

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy is more affordable than whole life insurance, making it a popular choice for those looking for temporary coverage

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. In addition to the death benefit, whole life insurance also includes a cash value component that grows over time. This type of policy tends to have higher premiums compared to term life insurance but offers lifelong coverage and the ability to accumulate cash value.

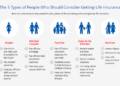

Suitability of Each Type of Policy

- Term life insurance may be more suitable for individuals who need coverage for a specific period, such as until their children are grown or their mortgage is paid off.

- Whole life insurance may be a better option for those looking for lifelong coverage and the ability to build cash value over time. It can also serve as an estate planning tool or provide funds for final expenses.

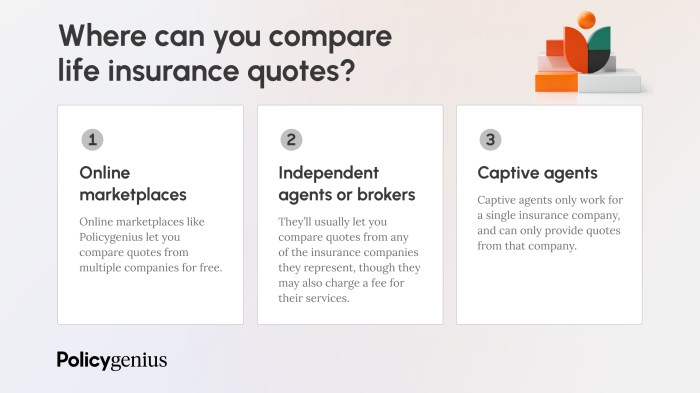

Obtaining and Comparing Life Insurance Quotes

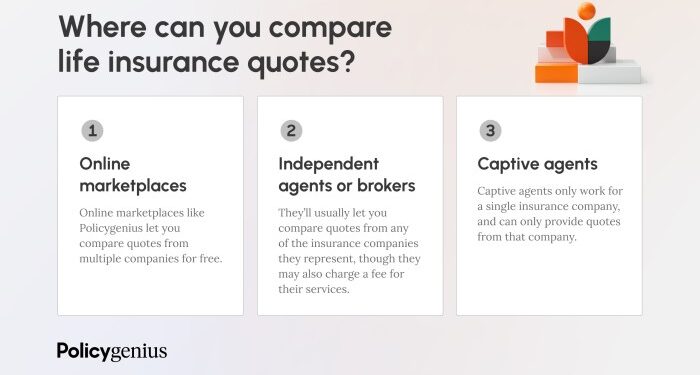

When it comes to obtaining and comparing life insurance quotes, there are several important steps to consider. By understanding the process and knowing what factors to look for, you can make an informed decision that best suits your needs.

Obtaining a Life Insurance Quote

- Research different insurance providers: Start by researching reputable insurance companies and requesting quotes from them.

- Provide accurate information: Make sure to provide accurate information about your health, lifestyle, and coverage needs to get an accurate quote.

- Consider different coverage options: Understand the different types of life insurance policies available and choose the one that aligns with your financial goals.

Comparing Life Insurance Quotes

- Review coverage details: Compare the coverage amount, premiums, and policy terms offered by each insurance provider.

- Look at additional benefits: Consider any additional benefits or riders that are included in the policy, such as disability or critical illness coverage.

- Check the financial stability of the insurer: Research the financial strength and reputation of the insurance company to ensure they can fulfill their obligations.

Importance of Reviewing Policy Details

- Understand the terms and conditions: Carefully review the policy details, including exclusions, restrictions, and any potential penalties.

- Ensure the coverage meets your needs: Make sure the policy provides the coverage you need to protect your loved ones financially in case of an unexpected event.

- Ask questions: If you have any doubts or uncertainties about the policy, don't hesitate to ask the insurance provider for clarification.

Last Recap

As we conclude this exploration of life insurance quotes, it becomes evident that being informed is the key to making sound financial decisions. Remember, the right policy can provide security and peace of mind for you and your loved ones.

Quick FAQs

What factors can influence the cost of a life insurance quote?

The cost of a life insurance quote can be influenced by factors such as age, health condition, lifestyle choices, and the coverage amount desired.

How do I compare quotes from different insurance providers?

To compare quotes effectively, gather quotes from multiple providers for the same coverage amount and duration. Analyze the benefits, exclusions, and premium costs to make an informed decision.

What is the difference between term life and whole life insurance policies?

Term life insurance provides coverage for a specific period, while whole life insurance offers coverage for the entire lifetime of the insured individual. Whole life policies also have a cash value component.

When should I consider term life insurance over whole life insurance?

Term life insurance is often more affordable and suitable for covering specific financial obligations for a limited time, such as paying off a mortgage or funding a child's education.