Navigating the realm of homeowners insurance quotes can be a daunting task, but fear not. This guide is here to shed light on the intricacies of obtaining the best quote tailored to your needs. From understanding the basics to delving into coverage options, this comprehensive overview will equip you with the knowledge to make informed decisions.

Whether you're a first-time homeowner or looking to switch providers, this guide will serve as your compass in the world of homeowners insurance quotes.

Understanding Homeowners Insurance Quote

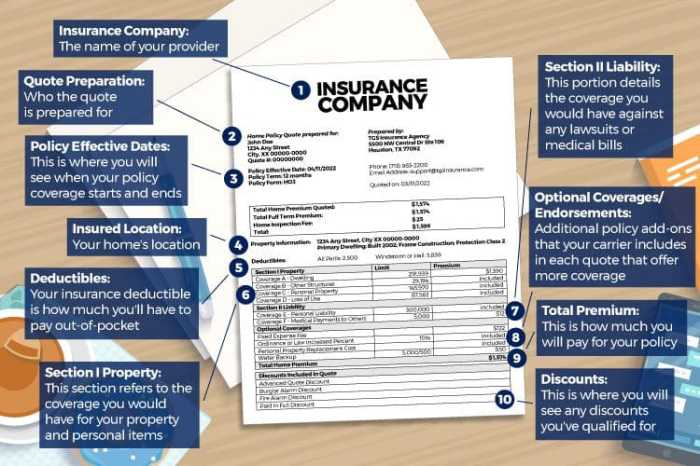

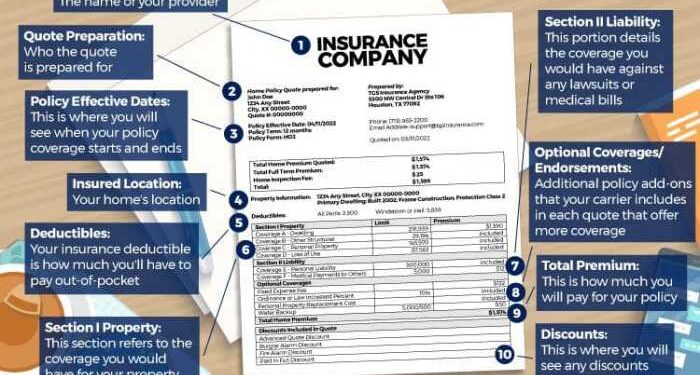

When it comes to protecting your home and belongings, obtaining a homeowners insurance quote is essential. This quote provides an estimate of the cost to insure your home against potential risks and damages.

Importance of Obtaining a Homeowners Insurance Quote

Getting a homeowners insurance quote allows you to understand the coverage options available to you and the associated costs. It helps you make an informed decision about protecting your investment and ensures that you are prepared for any unforeseen events that could damage your home.

- Provides financial protection: A homeowners insurance policy can help cover the cost of repairs or replacement in case of damage to your home due to fire, theft, or natural disasters.

- Meets mortgage requirements: Most mortgage lenders require homeowners insurance to protect their investment, making it a crucial step in the home buying process.

- Peace of mind: Knowing that your home and belongings are protected can give you peace of mind and security, especially during challenging times.

Factors Influencing Homeowners Insurance Quotes

Several factors can influence the cost of your homeowners insurance quote. Understanding these factors can help you make adjustments to your coverage options and ensure you are getting the best value for your money.

- Location: The location of your home plays a significant role in determining your insurance costs, as areas prone to natural disasters or high crime rates may have higher premiums.

- Home value and construction: The value of your home, its age, construction materials, and overall condition can impact the cost of insurance.

- Claims history: Your past insurance claims history can affect your insurance quote, as a history of frequent claims may result in higher premiums.

- Deductible amount: The deductible amount you choose can affect your insurance premium, with higher deductibles typically resulting in lower premiums.

Obtaining a Homeowners Insurance Quote

When you're ready to obtain a homeowners insurance quote, there are a few key steps to keep in mind to ensure you get the best coverage at the most competitive rate.

Process of Obtaining a Homeowners Insurance Quote

- Start by researching different insurance providers either online or through referrals from friends and family.

- Contact the insurance companies directly or use online tools to request a quote by providing information about your home, such as its location, size, age, and any special features.

- Consider scheduling an appointment with an insurance agent to discuss your specific needs and get a more personalized quote.

- Review the quotes received, compare coverage options, deductibles, limits, and premiums to make an informed decision.

- Select the best homeowners insurance policy that meets your needs and budget.

Tips for Comparing Quotes

- Ensure you're comparing quotes for similar coverage levels to make an accurate comparison.

- Look out for any exclusions or limitations in the policy that could impact your coverage in the future.

- Consider the financial strength and reputation of the insurance company to ensure they can fulfill their obligations in case of a claim.

- Check for discounts or bundling options that could help you save money on your homeowners insurance.

- Don't just focus on the price - consider the overall value and service provided by the insurance company.

Importance of Accuracy

- Provide accurate information about your home when requesting a quote to ensure you get the right coverage.

- Inaccurate information could lead to a policy that doesn't adequately protect your home or could result in denied claims in the future.

- Be honest about any features of your home, such as a swimming pool or trampoline, as these could impact your coverage and premiums.

- Review the details of your quote carefully to make sure all the information is correct before finalizing your homeowners insurance policy.

Coverage Options in Homeowners Insurance

When obtaining a homeowners insurance quote, it is essential to understand the different coverage options available to protect your home and belongings in case of unexpected events. These coverage options can vary based on the insurance provider and the specific needs of the homeowner.

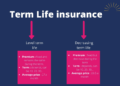

Basic Coverage Options vs. Additional Riders or Endorsements

Basic coverage options in homeowners insurance typically include dwelling coverage, which protects the structure of your home, personal property coverage for belongings inside the home, liability coverage for accidents that occur on your property, and additional living expenses coverage if you're temporarily displaced from your home due to a covered event.On the other hand, additional riders or endorsements provide extra protection for specific items or situations not covered by basic insurance.

For example, you may need to add a rider for expensive jewelry, fine art, or collectibles that exceed the standard personal property coverage limits

Coverage Limits and Deductibles Impact on Quote

Coverage limits and deductibles play a significant role in determining the cost of your homeowners insurance quote. Coverage limits refer to the maximum amount your insurance provider will pay for a covered loss, while deductibles are the out-of-pocket amount you must pay before your insurance kicks in.Higher coverage limits and lower deductibles typically result in higher insurance premiums, while lower coverage limits and higher deductibles can lower your premium costs.

It's crucial to strike a balance between coverage limits and deductibles that align with your budget and provide adequate protection for your home and possessions.When obtaining a homeowners insurance quote, consider how coverage limits and deductibles impact the overall cost and tailor your policy to best suit your needs and financial situation.

Factors Influencing Homeowners Insurance Quotes

When it comes to determining homeowners insurance quotes, several key factors come into play. These factors can significantly impact the cost of your insurance premiums. Let's delve into some of the main elements that influence homeowners insurance quotes.

Location

The location of your home plays a crucial role in determining your insurance quotes. Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, may have higher insurance premiums due to the increased risk of damage.

Home Value and Construction Materials

The value of your home and the materials used in its construction are essential factors in calculating insurance quotes. A more expensive home or one built with high-end materials may result in higher insurance premiums to ensure adequate coverage in case of damage or loss.

Homeowner’s Claim History

Your claim history as a homeowner can also impact your insurance quotes. If you have a history of filing multiple claims, insurers may consider you a higher risk, leading to increased premiums. Maintaining a claim-free record can help keep your insurance costs down.

Security Features

The security features of your home, such as alarms, deadbolts, and security cameras, can affect insurance premiums. Homes with robust security systems are less susceptible to theft or vandalism, making them less risky to insure. Installing security features can potentially lower your insurance costs.

Saving Money on Homeowners Insurance Quotes

When it comes to homeowners insurance, finding ways to save money on your quotes can be a game-changer. By taking advantage of discounts and exploring different options, you can lower your premiums without sacrificing coverage.One way to save money on homeowners insurance is by bundling your home and auto insurance policies with the same company.

Insurance companies often offer discounts to customers who have multiple policies with them, making it a cost-effective choice for many homeowners.

Exploring Discounts and Savings Opportunities

- Consider installing safety features in your home, such as smoke detectors, security systems, or storm shutters. Insurance companies may offer discounts for these added protections.

- Ask your insurance provider about discounts for being a non-smoker, having good credit, or being a long-term customer. These factors can sometimes lead to lower premiums.

- Review your policy regularly and make adjustments based on changes in your home or lifestyle. Removing coverage you no longer need or increasing your deductible can help reduce your premiums.

Concluding Remarks

In conclusion, securing the right homeowners insurance quote is not just about protecting your property—it's about peace of mind. By considering the factors influencing quotes and exploring coverage options, you can make confident choices that safeguard your home. As you embark on this journey, remember that knowledge is your strongest ally in the realm of homeowners insurance.

Commonly Asked Questions

How do I obtain a homeowners insurance quote?

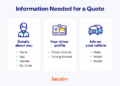

To get a homeowners insurance quote, you typically need to provide information about your property, such as its location, value, and construction materials, to insurance companies who will then calculate a quote based on these details.

What factors can impact homeowners insurance quotes?

Factors like the location of your home, its value, construction materials, claim history, and security features can all influence the quotes you receive from insurance providers.

Are there ways to save money on homeowners insurance quotes?

You can lower your insurance quotes by taking steps such as increasing home security, bundling home and auto insurance policies, and exploring discounts offered by insurance companies.

![Top 10 Best Home Insurance Companies Rates [The Truth]](https://nz.aboutmalang.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates-75x75.png)