As we delve into the realm of homeowners insurance companies, a rich history unfolds before us. Understanding the significance of selecting a trustworthy insurance provider is paramount. From the array of services they offer to the intricate factors to consider, this guide will navigate you through the world of homeowners insurance companies.

Overview of Homeowners Insurance Companies

When it comes to protecting your home and belongings, homeowners insurance companies play a crucial role in providing financial security and peace of mind. These companies have a long history dating back to the late 17th century in England, where the concept of property insurance originated to protect against fire damage.

Over the years, homeowners insurance companies have evolved to offer a wide range of services to meet the diverse needs of homeowners.Choosing a reputable homeowners insurance company is essential to ensure that you receive the best coverage and service in times of need.

A reliable company will have a strong financial standing, excellent customer service, and a track record of efficiently handling claims. By selecting a reputable company, you can trust that your home and belongings are adequately protected in case of unforeseen events such as natural disasters, theft, or accidents.

Types of Services Offered by Homeowners Insurance Companies

- Property Coverage: Homeowners insurance policies typically include coverage for the physical structure of your home, as well as other structures on your property such as garages, sheds, and fences. This coverage helps repair or rebuild your home in case of damage from covered perils.

- Personal Property Coverage: In addition to the structure of your home, homeowners insurance also covers your personal belongings such as furniture, clothing, and electronics. This coverage helps replace or repair your possessions in case of theft, vandalism, or other covered incidents.

- Liability Protection: Homeowners insurance provides liability protection in case someone is injured on your property and you are found legally responsible. This coverage can help pay for medical expenses, legal fees, and damages if you are sued.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, homeowners insurance can also cover the cost of temporary living arrangements such as hotel stays or rental accommodations.

Factors to Consider When Choosing a Homeowners Insurance Company

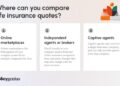

When selecting a homeowners insurance company, there are several key factors to consider to ensure you are getting the best coverage and service for your needs. Factors such as coverage options, customer service, financial stability, reputation, reviews, and pricing structures all play a crucial role in making an informed decision.

Coverage Options

- Review the types of coverage offered by the insurance company, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Consider any additional coverage options available for specific risks or valuable items that you want to protect.

- Ensure that the coverage limits and deductibles align with your needs and budget.

Customer Service

- Research the company's customer service reputation through online reviews, ratings, and testimonials from existing policyholders.

- Contact the company directly to gauge the responsiveness, knowledge, and helpfulness of their customer service representatives.

- Consider how easy it is to file a claim and how efficiently claims are processed by the company.

Financial Stability

- Check the financial strength ratings of the insurance company from independent rating agencies like A.M. Best, Standard & Poor's, and Moody's.

- Ensure that the company has the financial stability to fulfill claims in case of a large-scale disaster or event.

- Avoid companies with a history of financial instability or frequent rate fluctuations.

Reputation and Reviews

- Read reviews and testimonials from current and former policyholders to get an idea of the company's reputation for customer satisfaction and claims handling.

- Consider any complaints or negative feedback about the company's service, coverage options, or claims process.

- Choose a company with a strong reputation for reliability, transparency, and fairness in dealing with policyholders.

Pricing Structures

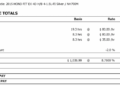

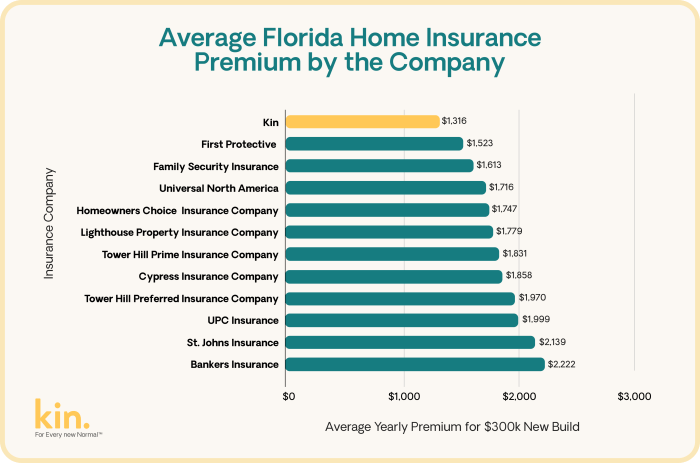

- Compare quotes from multiple homeowners insurance companies to understand the pricing differences based on coverage levels, deductibles, and discounts.

- Consider the overall value of the policy in relation to the premium cost, including the coverage limits, deductibles, and additional benefits offered.

- Avoid choosing a policy solely based on price; prioritize the coverage and service quality provided by the insurance company.

Top Homeowners Insurance Companies in the Market

When it comes to homeowners insurance, there are several top companies in the market that stand out for their offerings and market share. Let's take a closer look at some of these top homeowners insurance companies and compare them based on their strengths, weaknesses, and unique features.

Allstate

Allstate is one of the largest homeowners insurance companies in the market, known for its extensive coverage options and personalized service. They have a strong financial stability rating, which can provide peace of mind to policyholders. However, some customers have reported higher premiums compared to other companies in the market.

State Farm

State Farm is another leading homeowners insurance company with a strong presence in the market. They offer a wide range of coverage options and discounts for policyholders. State Farm is known for its excellent customer service and claims processing. One potential weakness is that their premiums may be slightly higher than other competitors.

GEICO

GEICO, known for its auto insurance, also offers homeowners insurance with competitive rates and discounts. They have a user-friendly online platform for policy management and claims processing. However, GEICO may not offer as many coverage options as some other top companies in the market.

USAA

USAA is highly regarded for its exceptional customer service and coverage options tailored to military members and their families. They consistently receive high customer satisfaction ratings. However, USAA is only available to military members, veterans, and their families, which may limit its accessibility to the general public.

Lemonade

Lemonade is a newer player in the homeowners insurance market, known for its innovative approach and digital platform. They offer fast and easy online quotes, policy management, and claims processing. One of their unique features is their giveback program, where leftover premiums are donated to charitable causes.

However, Lemonade's coverage options may be more limited compared to traditional insurers.

Claims Process and Customer Experience

When it comes to homeowners insurance, the claims process and overall customer experience are crucial factors that can significantly impact a policyholder's satisfaction with their insurance company. A smooth and efficient claims process can make a difficult situation much easier to handle, while poor customer service can lead to frustration and dissatisfaction.

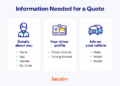

Typical Claims Process with Homeowners Insurance Companies

- Policyholder files a claim with the insurance company, providing details of the incident and any relevant documentation.

- Insurance company assigns an adjuster to assess the damage and determine coverage.

- Once the claim is approved, the insurance company provides compensation to the policyholder based on their coverage.

- Policyholder can choose to make repairs or replacements using the compensation received.

Examples of Customer Experiences

Positive Customer Experience: Company A

Company A handled my claim quickly and efficiently, keeping me informed throughout the process. The adjuster was professional and helpful, and I received fair compensation for the damage to my home.

Negative Customer Experience: Company B

Company B delayed processing my claim, and the adjuster was unresponsive to my inquiries. When my claim was finally approved, the compensation offered was much lower than expected, leading to additional stress and financial burden.

Impact of Customer Service on Satisfaction

- Quality customer service can enhance the overall experience for policyholders, increasing satisfaction and loyalty to the insurance company.

- Responsive and helpful representatives, clear communication, and efficient claims processing can all contribute to a positive customer service experience.

- On the other hand, poor customer service, such as delays, unresponsiveness, or inadequate compensation, can lead to frustration and dissatisfaction, potentially causing policyholders to switch to a different insurance provider.

Epilogue

In conclusion, homeowners insurance companies play a crucial role in safeguarding your most valuable asset - your home. By weighing the key factors and exploring the top companies in the market, you can make an informed decision that ensures peace of mind.

Remember, the claims process and customer experience are vital aspects to consider for a seamless homeowners insurance journey.

Q&A

How do I choose the right homeowners insurance company?

Consider factors such as coverage options, customer service quality, financial stability, and company reputation before making a decision.

What services are typically offered by homeowners insurance companies?

Services may include property damage coverage, liability protection, and additional living expenses coverage in case of emergencies.

Can customer reviews influence my choice of homeowners insurance company?

Absolutely. Reviews provide insights into the overall customer experience and satisfaction levels, helping you gauge the company's reliability.