Exploring the realm of cheap auto insurance quotes, this article delves into the various factors that influence pricing, the strategies to obtain a cost-effective quote, coverage options to consider, and the role of technology in the insurance industry. Get ready to uncover valuable insights on securing budget-friendly auto insurance coverage.

Factors Affecting Cheap Auto Insurance Quote

When looking for a cheap auto insurance quote, several factors come into play that can significantly impact the cost of your insurance premium. Understanding these factors can help you make informed decisions and potentially lower your insurance costs.

Personal Driving History

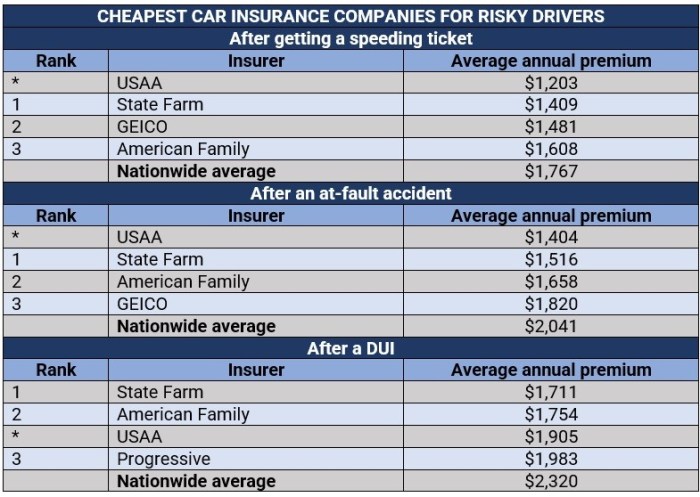

Your personal driving history is one of the key factors that insurance companies consider when determining your insurance rates. If you have a history of accidents, traffic violations, or claims, you may be considered a higher risk driver, leading to higher premiums.

On the other hand, a clean driving record can result in lower insurance rates as you are seen as a safer driver.

Make and Model of Vehicle

The make and model of your vehicle can also affect your auto insurance costs. Insurance companies take into account factors such as the cost of repairs, safety ratings, likelihood of theft, and overall risk associated with the vehicle. Generally, expensive or high-performance vehicles will have higher insurance premiums compared to more affordable and less risky models.

Location and Demographics

Your location and demographics play a significant role in determining your auto insurance quotes. Urban areas with higher rates of accidents or theft may result in higher premiums. Additionally, factors such as age, gender, marital status, and credit score can also impact your insurance rates.

Younger drivers, male drivers, and individuals with poor credit scores may face higher insurance costs compared to older, female drivers with good credit.

Strategies to Obtain a Cheap Auto Insurance Quote

When it comes to getting an affordable auto insurance quote, there are several strategies you can implement to lower your premiums and save money in the long run.

Comparing Quotes from Different Providers

One of the most effective ways to secure a cheap auto insurance quote is by comparing quotes from different insurance providers. By obtaining quotes from multiple companies, you can identify the best deal that suits your budget and coverage needs.

Bundling Insurance Policies for Cost Savings

Another strategy to consider is bundling your insurance policies with the same provider. Many insurance companies offer discounts to customers who purchase multiple policies, such as auto and home insurance, from them. By bundling your policies, you can enjoy cost savings and reduce your overall insurance expenses.

Maintaining a Good Credit Score

It's essential to maintain a good credit score if you want to secure affordable insurance rates. Insurance companies often use credit scores as a factor in determining premiums, with lower scores typically resulting in higher rates. By improving your credit score through responsible financial habits, you can potentially lower your auto insurance costs.

Understanding Coverage Options for Cheap Auto Insurance

When it comes to selecting coverage options for cheap auto insurance, it is essential to understand the different types available and how they can impact your policy. Let's delve into the key coverage options and their significance in helping you secure affordable auto insurance.

Liability, Collision, and Comprehensive Coverage

- Liability Coverage:This type of coverage helps pay for damages or injuries to others if you are at fault in an accident. It is typically required by law and helps protect you financially.

- Collision Coverage:Collision coverage helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage:Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

Benefits of Adding Uninsured/Underinsured Motorist Coverage

- Adding uninsured/underinsured motorist coverage can provide financial protection in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- It helps cover medical expenses, lost wages, and other damages that may not be covered by the other driver's insurance.

Deductibles and Coverage Limits Impact on Insurance Quotes

- Choosing higher deductibles can lower your insurance premiums, but it means you will have to pay more out of pocket in the event of a claim.

- On the other hand, opting for lower coverage limits can reduce your premiums but may leave you underinsured in case of a significant accident.

- It is essential to find the right balance between deductibles and coverage limits to ensure you have adequate protection at an affordable price.

Utilizing Technology for Cheap Auto Insurance

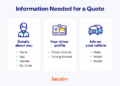

In today's digital age, technology plays a significant role in helping consumers find affordable auto insurance options. From telematics devices to online comparison tools, advancements in technology have made it easier than ever to secure cheap auto insurance quotes.Telematics Devices and Usage-Based Insurance:Telematics devices, such as plug-in devices or smartphone apps, track your driving habits, including speed, mileage, and braking patterns.

By opting for usage-based insurance, where premiums are based on actual driving behavior, safe drivers can often enjoy lower insurance rates. Insurers can offer discounts to policyholders who demonstrate safe driving practices through telematics data.Online Comparison Tools:Online comparison tools allow consumers to easily compare quotes from multiple insurance providers in a matter of minutes.

These tools help you find the best coverage at the most competitive rates, saving you time and money. By inputting your information once, you can receive quotes from various insurers and choose the one that best fits your budget and needs.Mobile Apps for Insurance Management:Many insurance companies now offer mobile apps that allow policyholders to manage their insurance policies on the go.

These apps enable you to track your insurance costs, make payments, access policy documents, and even file claims directly from your smartphone. By leveraging mobile apps, you can stay organized and informed about your insurance coverage, ensuring you are getting the best deal possible.Examples of Technological Advancements in Insurance:The insurance industry has undergone a digital transformation, with various technologies being utilized to streamline processes and offer more affordable options to consumers.

For instance, AI-powered chatbots are being used to provide instant customer support, while blockchain technology is enhancing data security and reducing fraud. These technological advancements have paved the way for innovative insurance products and services that cater to the changing needs of consumers.

Wrap-Up

In conclusion, navigating the world of cheap auto insurance quotes involves understanding the key factors affecting pricing, implementing smart strategies to lower costs, choosing the right coverage options, and leveraging technology for savings. By staying informed and proactive, you can secure the best auto insurance deal that meets your needs without breaking the bank.

Key Questions Answered

What factors influence the cost of auto insurance quotes?

The key factors include driving history, vehicle make and model, location, and demographics.

How can I lower auto insurance premiums?

You can lower premiums by comparing quotes, bundling policies, and maintaining a good credit score.

What are the types of coverage options available for cheap auto insurance?

Coverage options include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

How can technology help in obtaining cheap auto insurance?

Technology like telematics devices, online comparison tools, and mobile apps can lead to lower premiums and better management of insurance costs.

![Top 10 Best Home Insurance Companies Rates [The Truth]](https://nz.aboutmalang.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates-75x75.png)