As car insurance quote takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Car insurance is a crucial aspect of being a responsible driver, and obtaining the right quote can make all the difference. From understanding the various coverage options to tips for getting the best deal, this guide will equip you with the knowledge needed to navigate the world of car insurance quotes effectively.

Importance of Car Insurance Quote

Getting a car insurance quote is crucial for all drivers as it provides essential information about the cost and coverage options available. Without a car insurance quote, drivers may end up with inadequate coverage or pay more than necessary.

Benefits of Car Insurance Quote

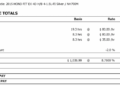

- Allows drivers to compare prices from different insurance providers to find the best deal.

- Helps drivers understand the specific coverage options available and choose the one that meets their needs.

- Provides transparency on the cost of insurance premiums, allowing drivers to budget accordingly.

Impact of Not Having an Accurate Car Insurance Quote

Not having an accurate car insurance quote can lead to several negative consequences for drivers:

- Underinsured: Drivers may not have enough coverage in case of an accident or damage to their vehicle.

- Overpaying: Without comparing quotes, drivers may end up paying more than necessary for their car insurance.

- Financial Risk: Inadequate coverage can leave drivers financially vulnerable in the event of a claim or lawsuit.

Factors Influencing Car Insurance Quotes

When it comes to determining the cost of car insurance, several factors come into play. These factors can significantly impact the quotes you receive from insurance providers. Understanding these influences can help you make informed decisions when shopping for car insurance.

Age

Age is a key factor that insurance companies consider when calculating car insurance quotes. Younger drivers, especially those under 25, are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

On the other hand, older drivers, particularly those over 50, may receive lower insurance rates as they are perceived as more experienced and safer on the road.

Driving Record

Your driving record is another critical factor that insurers take into account. A clean driving record with no accidents or traffic violations can lead to lower insurance premiums, as it demonstrates responsible driving behavior. Conversely, a history of accidents, speeding tickets, or DUI convictions can result in higher insurance rates, as it indicates a higher risk of future claims.

Type of Vehicle

The type of vehicle you drive also plays a significant role in determining your car insurance costs. High-performance cars, luxury vehicles, and sports cars are typically more expensive to insure due to their higher repair costs and increased likelihood of theft.

On the other hand, economical and safe vehicles are generally cheaper to insure as they are considered less risky.

Location

Your location can impact your car insurance quotes as well. Urban areas with higher population densities and increased traffic congestion tend to have higher insurance rates due to a greater risk of accidents and theft. Additionally, areas prone to severe weather conditions or high crime rates may also result in higher premiums.

On the other hand, rural areas with lower crime rates and less traffic congestion often have lower insurance costs.

Coverage Options

The coverage options you choose can also influence the cost of your car insurance. Opting for comprehensive coverage, which includes protection against a wide range of risks, will result in higher premiums compared to basic liability coverage. Additionally, adding extras like roadside assistance, rental car reimbursement, and gap coverage can increase your insurance costs.

It's essential to carefully consider your coverage needs and budget when selecting insurance options.

Types of Car Insurance Coverage

When it comes to car insurance, there are various types of coverage options available to suit different needs and budgets. Understanding the different types of car insurance coverage can help you make an informed decision when selecting a policy.

Comprehensive Coverage

Comprehensive coverage provides protection against damages to your car that are not caused by a collision. This can include theft, vandalism, natural disasters, and more. While comprehensive coverage is optional, it can provide added peace of mind.

Collision Coverage

Collision coverage helps pay for repairs to your car if it is damaged in a collision with another vehicle or object. This coverage is also optional but can be beneficial if you are involved in an accident.

Liability Coverage

Liability coverage is mandatory in most states and helps cover the costs of injuries and property damage that you are legally responsible for in an accident. This coverage is divided into two parts: bodily injury liability and property damage liability.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or is underinsured. This coverage can help cover medical expenses and damages to your vehicle.Each type of coverage influences the car insurance quote differently.

Comprehensive and collision coverage are optional, so adding them to your policy will increase the cost of your premium. Liability coverage is mandatory in most states, and the amount of coverage you choose will impact your premium

Tips for Getting the Best Car Insurance Quote

When it comes to getting the best car insurance quote, there are several strategies you can follow to ensure you are getting the most competitive rate possible. Comparing quotes from different insurance companies and working on improving your driving record can help lower your insurance costs significantly.

Compare Quotes from Different Insurance Companies

When looking for car insurance, it's essential to compare quotes from multiple insurance companies. Rates can vary significantly between providers, so taking the time to shop around can help you find the best deal. Consider factors like coverage options, deductibles, and discounts offered by each company before making a decision.

Improve Your Driving Record

One of the most effective ways to lower your car insurance costs is to improve your driving record. Safe drivers are often rewarded with lower insurance premiums, so avoiding accidents and traffic violations can help you qualify for better rates.

Consider taking defensive driving courses or installing safety features in your vehicle to demonstrate your commitment to safe driving.

Understanding Discounts and Savings

When it comes to car insurance, understanding discounts and savings can play a significant role in reducing your insurance premiums. By taking advantage of various discounts offered by insurance companies, you can potentially save a significant amount of money on your policy.

Common Discounts

Insurance companies often provide discounts to policyholders who meet certain criteria. Some of the common discounts include:

- Multi-policy discount: This discount is available to customers who have multiple insurance policies with the same company, such as home and auto insurance.

- Good driver discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a good driver discount.

- Safety feature discount: Installing safety features in your vehicle, such as anti-theft devices or airbags, can also make you eligible for a discount on your insurance premium.

Taking advantage of these discounts can lead to substantial savings on your car insurance. By meeting the criteria for these discounts, you can lower your premium and make your insurance more affordable.

Online Tools and Resources for Comparing Quotes

When it comes to finding the best car insurance quote, utilizing online tools and resources can make the process much easier and more efficient. These platforms allow you to compare quotes from various insurance providers, helping you find the most competitive rates that suit your needs and budget.

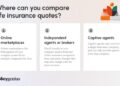

Step-by-Step Guide on Using Online Platforms

- Start by visiting reputable car insurance comparison websites or platforms.

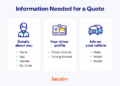

- Enter your personal information, vehicle details, and coverage preferences as accurately as possible.

- Compare the quotes provided by different insurance companies based on coverage options, premiums, deductibles, and discounts.

- Review the policy details and terms carefully to ensure you understand the coverage offered.

- Select the best car insurance quote that meets your requirements and budget.

Benefits of Using Online Resources

- Save Time: Online tools allow you to compare multiple quotes quickly without the need to contact each insurance company individually.

- Cost-Effective: You can find competitive rates and discounts easily, helping you save money on your car insurance policy.

- Convenience: Access quotes and policy information from the comfort of your home at any time that suits you.

- Transparency: Online platforms provide detailed information about coverage options and terms, empowering you to make an informed decision.

Closing Summary

In conclusion, navigating the realm of car insurance quotes can seem daunting at first, but armed with the information provided in this guide, you can make informed decisions that benefit both your wallet and your peace of mind. Remember, a little research and comparison can go a long way in securing the best car insurance quote tailored to your needs.

FAQ Corner

What factors can influence my car insurance quote?

Factors such as age, driving record, type of vehicle, location, and coverage options can all play a role in determining your car insurance quote.

How can I improve my driving record to lower insurance costs?

You can improve your driving record by practicing safe driving habits, attending defensive driving courses, and avoiding traffic violations.

What are some common discounts available for car insurance?

Common discounts include multi-policy discounts, good driver discounts, safety feature discounts, and discounts for low mileage.