Embark on a journey to explore the realm of the best private health insurance, where the quest for optimal coverage meets the intricacies of healthcare choices. Dive into the world of private health insurance and unlock the secrets to securing your well-being with the right plan.

Introduction to Private Health Insurance

Private health insurance refers to a type of insurance coverage that individuals purchase to help cover the costs of medical expenses, treatments, and services. Unlike public health insurance, which is provided by the government, private health insurance is offered by private companies or organizations.

Having private health insurance is important as it provides individuals with access to a wider range of healthcare options, shorter wait times for treatments and procedures, and the ability to choose their preferred healthcare providers and facilities. Private health insurance also offers additional benefits such as coverage for elective procedures, alternative therapies, and other services not typically covered by public health insurance.

Benefits of Private Health Insurance

- Greater choice of healthcare providers and facilities

- Shorter wait times for treatments and procedures

- Coverage for elective procedures and alternative therapies

- Access to additional services not typically covered by public health insurance

- Personalized healthcare options tailored to individual needs

Factors to Consider When Choosing the Best Private Health Insurance

When selecting the best private health insurance plan, there are several key factors to keep in mind to ensure you choose the most suitable option for your needs.

- Types of Private Health Insurance Plans:

- Private health insurance plans can vary in terms of coverage, cost, and flexibility. Some common types include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and High-Deductible Health Plan (HDHP).

Coverage

When evaluating private health insurance plans, it is important to consider the extent of coverage provided. This includes services such as hospital stays, doctor visits, prescription drugs, preventive care, and mental health services.

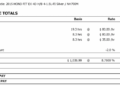

Cost

Cost is a significant factor when choosing a private health insurance plan. Be sure to compare premiums, deductibles, copayments, and coinsurance amounts to determine the overall cost of the plan. Consider your budget and how much you are willing to pay for healthcare services.

Network of Providers

Another crucial factor to consider is the network of healthcare providers included in the private health insurance plan. Check if your preferred doctors, specialists, hospitals, and healthcare facilities are part of the plan's network to ensure you have access to the care you need.

Flexibility

Evaluate the flexibility of the private health insurance plan in terms of choosing healthcare providers and receiving care outside the network. Some plans offer more flexibility in selecting providers, while others require you to stay within the network for coverage.

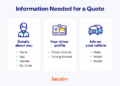

Assessing Your Healthcare Needs

To determine the most suitable private health insurance plan, assess your healthcare needs based on factors such as your medical history, chronic conditions, anticipated healthcare services, and preferred providers. Consider whether you need comprehensive coverage or if a more basic plan would suffice.

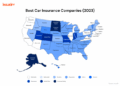

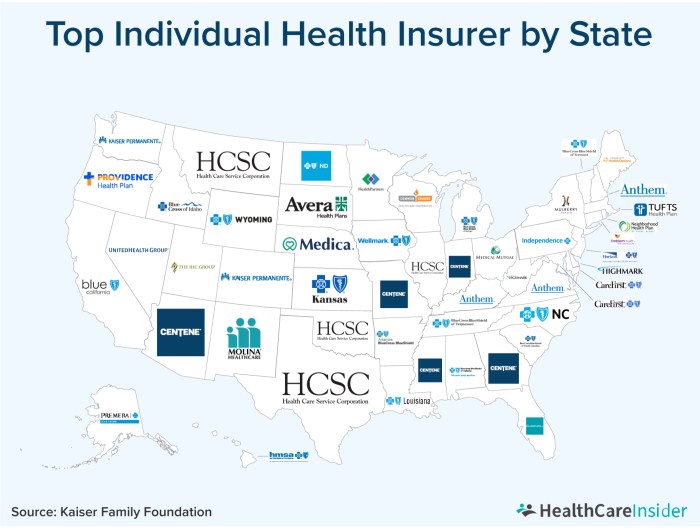

Top Private Health Insurance Providers

When it comes to choosing the best private health insurance provider, there are several top companies that stand out for their offerings, coverage, and customer satisfaction. Let's take a closer look at some of the leading private health insurance providers in the market today.

Kaiser Permanente

Kaiser Permanente is known for its comprehensive coverage options, including preventive care, specialist visits, and hospital stays. They have a strong network of healthcare providers and are rated highly for customer satisfaction.

UnitedHealthcare

UnitedHealthcare offers a wide range of health insurance plans to meet the diverse needs of individuals and families. They provide innovative wellness programs and digital tools for easy access to care.

Anthem Blue Cross Blue Shield

Anthem Blue Cross Blue Shield is a trusted name in the health insurance industry, offering a variety of plans with competitive rates and extensive provider networks. They are known for their excellent customer service and reliable coverage options.

Cigna

Cigna is a global health service company that provides comprehensive health insurance plans, including medical, dental, and vision coverage. They focus on preventive care and wellness programs to help members stay healthy

Aetna

Aetna offers a wide range of health insurance products, including individual and group plans, as well as Medicare and Medicaid options. They have a strong reputation for financial stability and reliable coverage.These top private health insurance providers have established themselves as leaders in the industry, offering quality coverage, innovative solutions, and excellent customer service to their members.

Tips for Saving Money on Private Health Insurance

When it comes to private health insurance, finding ways to save money while still maintaining adequate coverage is essential. Here are some strategies to help you lower premium costs without compromising on the quality of your health insurance plan.

Understanding Deductibles, Copayments, and Coinsurance

One way to save money on private health insurance is by understanding the terms of your policy, including deductibles, copayments, and coinsurance. Deductibles are the amount you pay out of pocket before your insurance kicks in, while copayments are fixed amounts you pay for covered services.

Coinsurance is the percentage of costs you pay after meeting your deductible. By knowing these terms, you can make informed decisions about your healthcare expenses and potentially save money.

Taking Advantage of Discounts and Wellness Programs

Many private health insurance providers offer discounts or wellness programs to help their policyholders stay healthy and reduce healthcare costs. These programs may include discounts on gym memberships, nutrition counseling, or rewards for meeting certain health goals. By taking advantage of these offerings, you can not only save money on your premiums but also improve your overall health and well-being.

Understanding Policy Coverage and Exclusions

When choosing the best private health insurance, it is essential to have a clear understanding of the policy coverage and exclusions. This knowledge can help you make informed decisions about your healthcare needs and avoid unexpected costs.

Common Coverage Areas

- Hospital Stays: Most private health insurance plans cover the costs associated with hospital stays, including room charges, nursing care, and surgical procedures.

- Doctor Visits: Coverage for visits to primary care physicians, specialists, and other healthcare providers is typically included in private health insurance plans.

- Prescription Drugs: Many plans provide coverage for prescription medications, which can help reduce out-of-pocket costs for essential drugs.

- Preventive Care: Private health insurance often covers preventive services such as annual check-ups, vaccinations, and screenings to help maintain overall health.

Typical Exclusions

- Cosmetic Procedures: Private health insurance usually does not cover elective cosmetic surgeries or procedures performed for aesthetic purposes.

- Experimental Treatments: Treatments that are considered experimental or investigational may be excluded from coverage by private health insurance plans.

- Pre-existing Conditions: Some plans may exclude coverage for pre-existing medical conditions that existed before the start of the insurance policy.

Importance of Understanding Policy Coverage

Having a thorough understanding of your policy coverage is crucial for making informed healthcare decisions. For example, knowing what services are covered can help you plan for medical expenses and choose healthcare providers that are within your network. On the other hand, being aware of exclusions can prevent unexpected costs and ensure that you are prepared for any out-of-pocket expenses that may arise.

Conclusion

As we conclude this exploration of the best private health insurance options, remember that your health is your most valuable asset. With the right coverage in place, you can navigate the complexities of healthcare with confidence and peace of mind.

Choose wisely, stay informed, and prioritize your health above all else.

Frequently Asked Questions

What factors should I consider when choosing the best private health insurance?

Factors to consider include coverage, cost, network of providers, and flexibility. Assess your healthcare needs to determine the most suitable plan.

How can I save money on private health insurance without compromising coverage?

You can save money by understanding deductibles, copayments, and coinsurance. Take advantage of discounts or wellness programs offered by insurers.

What are common exclusions in private health insurance policies?

Exclusions may include cosmetic procedures, experimental treatments, and pre-existing conditions. Understanding these is crucial for informed healthcare decisions.