Diving into the world of auto insurance quotes, this introduction aims to provide a comprehensive overview of the topic. From understanding the key components to saving money on premiums, this guide covers it all in a clear and engaging manner.

Understanding Auto Insurance Quotes

When looking for auto insurance, it's essential to understand the components of an auto insurance quote, the factors that influence these quotes, and why comparing multiple quotes is crucial.

Key Components of an Auto Insurance Quote

- Liability Coverage: This covers costs associated with injuries or property damage to others in an accident you are deemed responsible for.

- Collision Coverage: This covers damage to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Deductibles: The amount you pay out of pocket before your insurance kicks in.

- Personal Injury Protection: Covers medical expenses and lost wages for you and your passengers in an accident.

Factors Influencing Auto Insurance Quotes

- Driving Record: A history of accidents or traffic violations can increase your premium.

- Vehicle Make and Model: The type of car you drive can affect your insurance rates.

- Location: Where you live can impact rates due to factors like crime rates and traffic congestion.

- Credit Score: Insurers may use your credit score to determine your premium.

Importance of Comparing Multiple Quotes

It's crucial to compare quotes from different insurance providers to ensure you're getting the best coverage at the most competitive price. By comparing quotes, you can find the right balance between cost and coverage that meets your needs.

Obtaining Auto Insurance Quotes

When it comes to getting auto insurance quotes, the process can vary depending on whether you choose to go through an agent or use online resources. Here, we will focus on the online method, which is becoming increasingly popular due to its convenience and accessibility.

Online Auto Insurance Quote Process

- Visit the website of the insurance provider or use a comparison website.

- Fill out a form with your personal information, vehicle details, and coverage preferences.

- Submit the form to receive a quote instantly or within a short period of time.

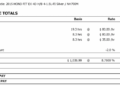

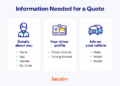

Information Required for a Quote

- Driver's license number and driving history.

- Vehicle make, model, year, and VIN.

- Current insurance coverage details.

- Mileage driven per year and primary use of the vehicle.

- Personal information such as address, age, and occupation.

Advantages of Different Sources

- Agents:Provide personalized assistance and advice tailored to your needs.

- Websites:Offer quick and easy access to multiple quotes for comparison.

- Comparison Websites:Allow you to view quotes from various insurers in one place.

Factors Affecting Auto Insurance Quotes

When it comes to auto insurance quotes, there are several key factors that can influence the premium rates you are quoted

Driving Record

Your driving record plays a significant role in determining your auto insurance quotes. A clean driving record with no accidents or traffic violations typically results in lower premiums, as it signals to insurers that you are a low-risk driver. On the other hand, a history of accidents or traffic infractions can lead to higher insurance rates.

Vehicle Type

The type of vehicle you drive can also impact your auto insurance quotes. Insurance companies consider factors such as the make and model of your car, its age, safety features, and likelihood of theft when calculating premiums. Generally, newer and more expensive vehicles will have higher insurance costs compared to older, more affordable cars.

Location

Where you live can influence your auto insurance quotes as well. Urban areas with higher rates of accidents, theft, and vandalism tend to have higher insurance premiums compared to rural areas. Additionally, states with no-fault insurance laws or high rates of uninsured drivers may also result in higher insurance costs.

Deductibles and Coverage Limits

The deductibles and coverage limits you choose for your auto insurance policy can impact the quotes you receive. A higher deductible typically leads to lower premiums, as you are agreeing to pay more out of pocket in the event of a claim.

On the other hand, higher coverage limits for liability, collision, and comprehensive coverage will result in higher premiums, as you are increasing the insurer's potential risk.

Saving Money on Auto Insurance

![USAA Car Insurance Guide [Best and Cheapest Rates + More] USAA Car Insurance Guide [Best and Cheapest Rates + More]](https://nz.aboutmalang.com/wp-content/uploads/2025/12/277b82f0-usaa-insurance-quote-screen.jpg)

When it comes to auto insurance, finding ways to save money is crucial. By understanding how to lower auto insurance quotes, comparing the benefits of bundling policies versus standalone auto insurance, and considering the impact of vehicle safety features, you can make informed decisions to reduce your insurance costs.

Strategies for Lowering Auto Insurance Quotes

- Consider raising your deductible to lower your premium.

- Ask about discounts for good driving records, multiple policies, or safety features.

- Shop around and compare quotes from different insurance companies.

- Review your coverage limits and adjust them based on your needs.

Benefits of Bundling Policies versus Standalone Auto Insurance

- Bundling policies, such as combining auto and home insurance, can often lead to discounted rates.

- Standalone auto insurance may offer more flexibility in terms of coverage options and customization.

- Consider your specific insurance needs and budget to determine the best option for you.

Impact of Vehicle Safety Features on Insurance Costs

- Vehicles equipped with safety features like anti-lock brakes, airbags, and anti-theft devices may qualify for lower insurance premiums.

- Insurance companies view safer vehicles as less risky to insure, which can result in cost savings for policyholders.

- Before purchasing a vehicle, consider the impact of safety features on insurance costs to make an informed decision.

Last Word

In conclusion, auto insurance quotes are a crucial aspect of financial planning for drivers. By knowing the factors that affect quotes and how to save money on premiums, individuals can make informed decisions when choosing the right coverage for their vehicles.

FAQ Corner

What factors can impact auto insurance quotes?

Factors such as driving record, vehicle type, and location can significantly influence the premium rates of auto insurance quotes.

Why is it important to compare multiple auto insurance quotes?

Comparing quotes from different sources helps individuals find the best coverage at the most competitive rates, saving them money in the long run.

How can one save money on auto insurance?

Strategies like bundling policies, maintaining a good driving record, and opting for safety features can help in lowering auto insurance costs.