Embark on a journey into the realm of health insurance tailored for freelancers, where the landscape is as diverse as the freelancers themselves. From understanding the nuances of insurance plans to discovering cost-saving strategies, this topic delves deep into the essentials freelancers need to know.

Exploring the intricacies of health insurance options specifically designed for freelancers, this guide aims to shed light on the complexities of navigating the healthcare system without traditional employment benefits.

Understanding Health Insurance for Freelancers

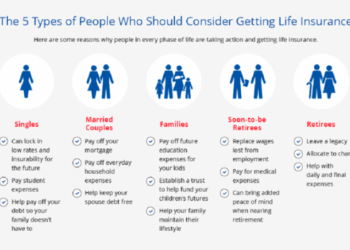

Health insurance for freelancers is a type of coverage that individuals purchase on their own to help cover medical expenses. Unlike traditional employer-provided health insurance, freelancers are responsible for selecting and paying for their own health insurance plans.

Importance of Having Health Insurance as a Freelancer

Having health insurance as a freelancer is crucial for ensuring access to quality healthcare services when needed without facing substantial financial burdens. It provides a safety net for unexpected medical emergencies and routine healthcare needs.

Differences between Employer-Provided and Individual Health Insurance for Freelancers

- Employer-Provided Health Insurance:

- Individual Health Insurance for Freelancers:

Employer-provided health insurance is typically offered as part of a benefits package by companies to their employees. The employer often covers a portion of the premium costs, making it more affordable for employees. However, freelancers do not have access to this benefit.

Individual health insurance for freelancers is purchased directly from insurance companies or through the health insurance marketplace. Freelancers have the flexibility to choose plans that suit their needs and budget, but they are responsible for paying the full premium amount without employer contributions.

Types of Health Insurance Plans

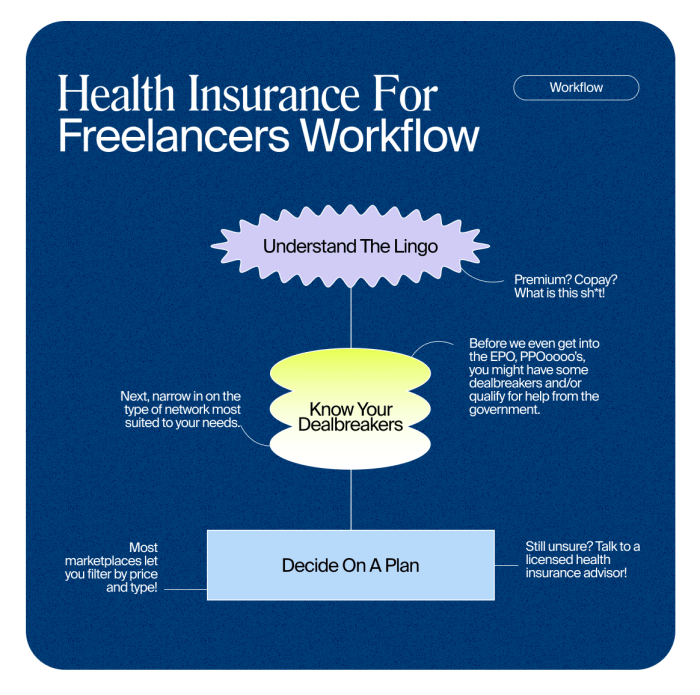

When it comes to health insurance plans for freelancers, there are several options to consider. It's important to understand the differences between each type to choose the one that best fits your needs and budget.

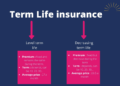

High Deductible Health Plans (HDHPs) vs. Traditional Health Insurance Plans

- High Deductible Health Plans (HDHPs) typically have lower monthly premiums but higher deductibles compared to traditional health insurance plans. This means you'll pay more out of pocket before your insurance starts covering costs.

- Traditional health insurance plans, on the other hand, usually have higher monthly premiums but lower deductibles. This could be a better option if you anticipate needing more healthcare services throughout the year.

- When comparing HDHPs and traditional plans, consider your overall health, anticipated medical expenses, and risk tolerance to determine which plan aligns best with your needs.

Benefits of Health Savings Accounts (HSAs)

- Health Savings Accounts (HSAs) are often paired with High Deductible Health Plans (HDHPs) and offer tax advantages for freelancers. Contributions to an HSA are tax-deductible, and funds can be used tax-free for qualified medical expenses.

- HSAs provide a way to save for current and future healthcare costs while allowing you to take advantage of tax benefits. These accounts can help freelancers better manage healthcare expenses and save for retirement.

- By utilizing an HSA along with a High Deductible Health Plan, freelancers can potentially lower their overall healthcare costs and have more control over how their healthcare dollars are spent.

Finding Affordable Health Insurance

Finding affordable health insurance as a freelancer can be a daunting task, but with the right strategies and knowledge, it is possible to secure a plan that fits your budget while providing adequate coverage.

Tips for Finding Affordable Health Insurance Options

- Compare Multiple Plans: Take the time to research and compare different health insurance plans to find one that offers the most value for your money.

- Consider High Deductible Plans: High deductible plans often come with lower monthly premiums, making them a more affordable option for freelancers.

- Utilize Health Insurance Marketplaces: Explore healthcare.gov or state-specific marketplaces to find subsidized health insurance plans that may offer lower costs.

- Join Freelancer Associations: Some freelancer associations offer group health insurance plans that can be more affordable than individual plans.

Cost-Saving Strategies for Freelancers

- Utilize Health Savings Accounts (HSAs): Consider opening an HSA to save pre-tax dollars for medical expenses, which can help offset the cost of high deductible health plans.

- Choose In-Network Providers: Opt for healthcare providers within your insurance plan's network to avoid higher out-of-pocket costs.

- Look for Telemedicine Options: Some health insurance plans offer telemedicine services, which can be a cost-effective way to receive medical care without incurring high expenses.

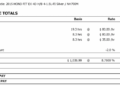

Eligibility for Subsidies or Tax Credits

- Income-Based Subsidies: Freelancers with low to moderate incomes may be eligible for subsidies to help lower the cost of health insurance premiums.

- Premium Tax Credits: Depending on your income level, you may qualify for premium tax credits that can be applied to reduce the cost of your health insurance plan.

- State-Specific Programs: Some states offer additional programs or subsidies for freelancers to make health insurance more affordable, so be sure to check for local resources.

Managing Health Insurance Coverage

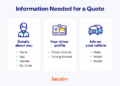

As a freelancer, it is essential to effectively manage your health insurance coverage to ensure you have the necessary protection for your healthcare needs. This involves understanding the details of your coverage, including deductibles, copayments, and out-of-pocket maximums, to make informed decisions about your healthcare.

Understanding Coverage Details

- Read through your health insurance policy to understand what services are covered and what costs you are responsible for.

- Pay attention to details such as deductibles, which are the amount you must pay before your insurance kicks in, copayments for each visit or service, and out-of-pocket maximums, which limit the amount you have to pay in a year.

- Knowing these details can help you plan your healthcare expenses and avoid unexpected costs.

Navigating the Healthcare System

- Find healthcare providers within your insurance network to minimize costs and maximize coverage.

- Keep track of your medical expenses and insurance claims to ensure accuracy and prevent billing errors.

- Consider using telemedicine services for non-emergency medical consultations, which can be more convenient and cost-effective.

- Take advantage of preventive care services covered by your insurance to maintain your health and catch any issues early.

Summary

As we conclude this exploration of health insurance for freelancers, it's evident that being informed and proactive about one's coverage is key to safeguarding one's health and financial well-being in the freelance world.

FAQ Explained

What are the benefits of having health insurance as a freelancer?

Health insurance provides financial protection against unexpected medical expenses, ensuring freelancers can access necessary healthcare without facing exorbitant costs.

How can freelancers find affordable health insurance options?

Freelancers can explore health insurance marketplaces, consider joining professional organizations for group rates, or opt for high deductible health plans to lower premiums.

What is the significance of Health Savings Accounts (HSAs) for freelancers?

HSAs offer tax advantages and a way to save for future medical expenses, making them a valuable complement to health insurance plans for freelancers.

How can freelancers effectively manage their health insurance coverage?

Freelancers should regularly review their coverage details, understand cost-sharing components like deductibles and copayments, and stay informed about network providers to maximize their benefits.