Embark on a journey to unravel the complexities of life insurance in a way that captivates and enlightens. As we delve into the realm of life insurance explained, prepare to gain a deeper understanding of this crucial aspect of financial planning.

In the following paragraphs, we will explore the different types of life insurance policies, how life insurance functions, and its significance in financial planning.

What is Life Insurance?

Life insurance is a financial product that provides a sum of money to beneficiaries upon the insured person's death. The primary purpose of life insurance is to provide financial protection and security for loved ones in the event of the policyholder's passing.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term.

- Whole Life Insurance: Offers coverage for the entire life of the insured person. It includes a cash value component that grows over time and can be borrowed against or withdrawn.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest over time. It provides flexibility in premium payments and coverage amounts.

- Variable Life Insurance: Allows the policyholder to allocate premiums to investment accounts. The cash value and death benefit can fluctuate based on the performance of the investments.

Benefits of Having Life Insurance Coverage

- Financial Protection: Life insurance ensures that loved ones are financially secure in the event of the insured's death, covering expenses like mortgage payments, debts, and future needs.

- Income Replacement: The death benefit from a life insurance policy can replace the income of the insured, helping to maintain the family's standard of living.

- Estate Planning: Life insurance can be used as part of an estate plan to provide liquidity for estate taxes, debts, and other expenses, ensuring a smooth transfer of assets to heirs.

- Potential Cash Value: Certain types of life insurance policies, like whole life and universal life, accumulate cash value over time that can be accessed during the policyholder's lifetime for various financial needs.

How Does Life Insurance Work?

Life insurance serves as a financial safety net for individuals and their loved ones. In the event of the policyholder's death, the insurance company pays out a sum of money, known as the death benefit, to the designated beneficiary. This financial support can help cover funeral expenses, outstanding debts, mortgage payments, and provide financial stability for the family left behind.

Selecting a Beneficiary

When purchasing a life insurance policy, the policyholder must designate a beneficiary who will receive the death benefit upon their passing. The beneficiary can be a family member, friend, or any individual or entity chosen by the policyholder. It is essential to keep the beneficiary designation up to date, especially after major life events such as marriage, divorce, or the birth of a child.

Determining Premiums

Several factors influence the cost of life insurance premiums, including the policyholder's age, health, lifestyle, occupation, and the coverage amount. Younger, healthier individuals typically pay lower premiums compared to older individuals or those with pre-existing medical conditions. Additionally, smokers and individuals with risky occupations may face higher premium rates due to the increased likelihood of premature death.

Types of Life Insurance Policies

When it comes to life insurance, there are several types of policies available to meet different needs and preferences. Understanding the differences between term life insurance, whole life insurance, universal life insurance, and variable life insurance can help you make an informed decision about which policy is right for you.

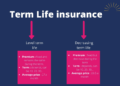

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the insured.

It also includes a cash value component that grows over time and can be borrowed against or withdrawn.

Universal Life Insurance

Universal life insurance is a flexible policy that allows you to adjust your premium payments and death benefit as needed. It offers a cash value component that earns interest based on current market rates. This type of policy provides the opportunity for potential growth while still offering a death benefit to beneficiaries.

Variable Life Insurance

Variable life insurance allows policyholders to invest their cash value in a variety of sub-accounts, such as stocks, bonds, or mutual funds. The cash value and death benefit can fluctuate based on the performance of the chosen investments

Determining Life Insurance Coverage

Determining the right amount of life insurance coverage is crucial to ensure financial security for your loved ones in the event of your passing. Factors such as your income, debts, and future expenses should be taken into consideration when calculating the appropriate coverage amount.

Calculating Coverage Amount

- Start by calculating your annual income and multiplying it by the number of years you want to replace that income for your dependents.

- Add up any outstanding debts, such as mortgage, car loans, or credit card balances.

- Consider future expenses, such as college tuition for your children or any other financial obligations.

- Factor in inflation and any additional costs that may arise in the future.

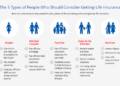

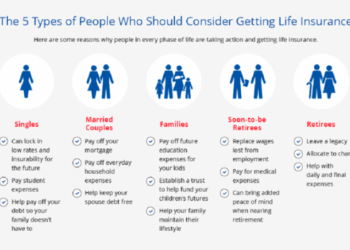

Length of Life Insurance Policy

- Determine the length of the policy based on the financial needs of your dependents. For example, if you have young children, you may want a policy that covers them until they are financially independent.

- Consider the age of your spouse and their ability to generate income in the future.

- Take into account any retirement savings or other assets that could support your dependents in the long run.

Examples of Coverage Amounts

- Scenario 1:A young couple with a mortgage and two young children may opt for a coverage amount that pays off the mortgage, covers living expenses, and provides for the children's education until they are adults.

- Scenario 2:An older couple with grown children and retirement savings may only need a smaller coverage amount to cover final expenses and any outstanding debts.

Importance of Life Insurance for Financial Planning

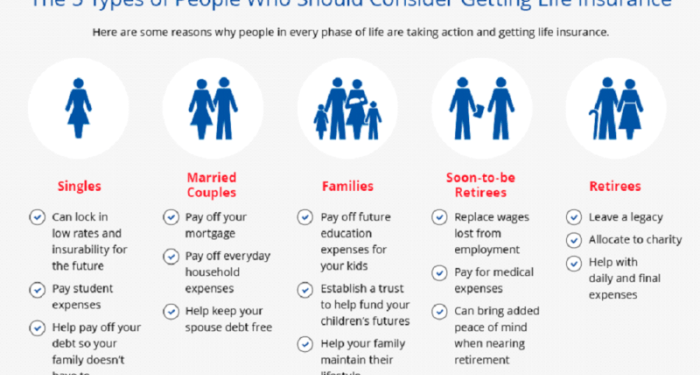

Life insurance plays a crucial role in an individual's overall financial plan by providing a safety net for loved ones in the event of the policyholder's death. It offers financial protection and peace of mind, ensuring that beneficiaries are taken care of financially.

Life Insurance in Estate Planning

Life insurance is a valuable tool in estate planning as it can help cover estate taxes and other expenses, allowing heirs to receive their inheritance without financial burden. It can also provide liquidity to the estate, ensuring assets are not sold off to cover debts or taxes.

Protecting Assets and Providing Financial Security

- Life insurance can protect assets by providing a source of funds that can be used to pay off debts, mortgages, and other financial obligations.

- It also offers financial security to loved ones by replacing the income of the policyholder, helping them maintain their standard of living after the loss of a breadwinner.

- Additionally, life insurance can be used to fund future expenses such as children's education, retirement savings, or charitable donations.

End of Discussion

In conclusion, life insurance serves as a vital tool in safeguarding the financial future of individuals and their loved ones. By comprehending the nuances of life insurance explained, one can make informed decisions that pave the way for a secure tomorrow.

General Inquiries

What factors determine life insurance premiums?

Life insurance premiums are determined based on various factors such as age, health condition, lifestyle, coverage amount, and type of policy.

How do I calculate the appropriate amount of life insurance needed?

To calculate the right amount of life insurance, consider factors like income replacement needs, outstanding debts, future expenses, and financial goals.

What is the role of life insurance in estate planning?

Life insurance can help in estate planning by providing liquidity to cover estate taxes, debts, and other expenses, ensuring a smooth transfer of assets.

What are the benefits of variable life insurance?

Variable life insurance offers the potential for cash value growth through investment options, providing flexibility and a chance for higher returns.

Why is life insurance important for financial security?

Life insurance plays a crucial role in ensuring financial security by providing a safety net for loved ones, protecting assets, and covering financial obligations.