Exploring the realm of term life insurance unveils a financial safety net that many individuals seek to secure their loved ones' future. From unraveling the basics to delving into its intricate details, this guide aims to shed light on the nuances of term life insurance.

As we navigate through the intricacies of this insurance option, you'll gain a deeper understanding of its significance and relevance in today's world.

Overview of Term Life Insurance

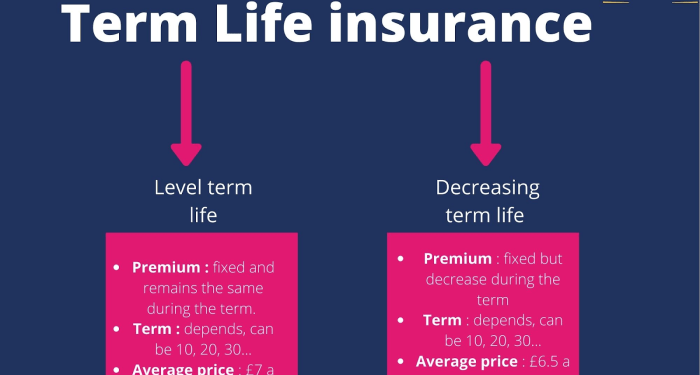

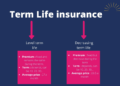

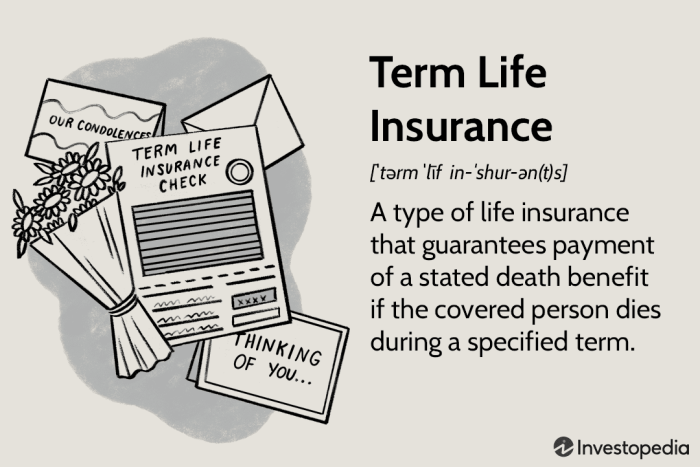

Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. Unlike whole life insurance, which covers you for your entire life, term life insurance is designed to provide protection for a set number of years.

One of the key features of term life insurance is that it offers a death benefit to your beneficiaries if you pass away during the term of the policy. This can help provide financial security for your loved ones in the event of your untimely death.

Additionally, term life insurance tends to be more affordable than whole life insurance, making it a popular choice for those looking for temporary coverage.

Features and Benefits of Term Life Insurance

- Flexibility in coverage length: Term life insurance allows you to choose the length of coverage that best fits your needs, whether it's 10, 20, or 30 years.

- Affordability: Term life insurance is generally more cost-effective than whole life insurance, making it a budget-friendly option for many individuals.

- Simple and straightforward: Term life insurance policies are typically easy to understand, with clear terms and coverage options.

- Renewable and convertible options: Some term life insurance policies offer the ability to renew or convert to a permanent life insurance policy at the end of the term.

Situations Where Term Life Insurance is Suitable

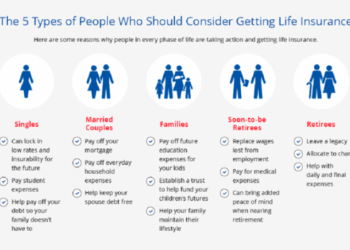

- Young families: Term life insurance can provide financial protection for your family during the years when they are most dependent on your income.

- Outstanding debts: If you have significant debts, such as a mortgage or student loans, term life insurance can help cover these obligations in the event of your passing.

- Business owners: Term life insurance can be beneficial for business owners looking to protect their business interests or provide for a smooth transition in ownership.

Coverage and Duration

Term life insurance provides coverage for a specified period of time, offering financial protection to your loved ones in the event of your death. The coverage amount, known as the death benefit, is paid out to your beneficiaries if you pass away during the term of the policy.

Coverage Provided by Term Life Insurance

- Death Benefit: The primary coverage provided by term life insurance is the death benefit, which is a tax-free lump sum payment given to your beneficiaries upon your death.

- Income Replacement: Term life insurance can help replace lost income, ensuring that your family can maintain their standard of living even after you're gone.

- Debt Repayment: It can also be used to pay off outstanding debts such as mortgages, loans, or credit card balances, relieving your loved ones of financial burdens.

Duration Options Available

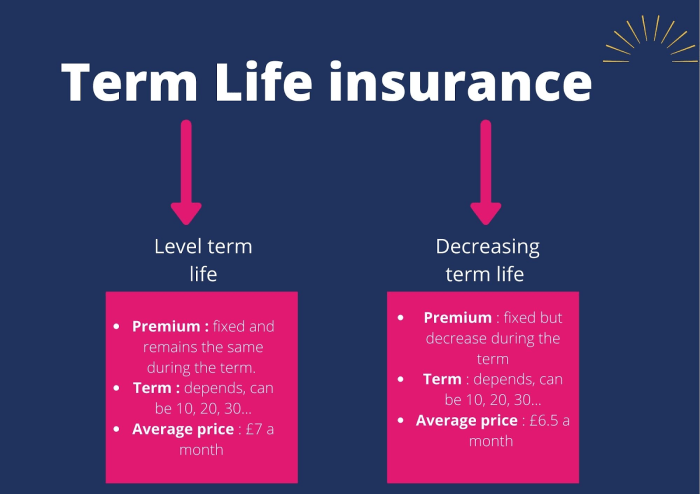

- Term Lengths: Term life insurance policies typically offer coverage for terms ranging from 10 to 30 years, allowing you to choose a duration that aligns with your financial obligations and needs.

- Renewability: Some policies may offer the option to renew or convert your term policy into a permanent life insurance policy at the end of the term, although this may come with increased premiums.

- Coverage Limits: Keep in mind that term life insurance coverage ends once the term expires, so if you outlive the policy, you will no longer have coverage unless you renew or convert the policy.

Comparison with Other Types of Life Insurance

- Term vs. Whole Life: Unlike term life insurance, whole life insurance provides coverage for your entire life and includes a cash value component that grows over time. However, whole life insurance premiums are significantly higher than term life insurance premiums.

- Term vs. Universal Life: Universal life insurance offers more flexibility than term life insurance, allowing you to adjust your premiums and coverage amounts. However, universal life insurance can be more complex and costly.

- Term vs. Variable Life: Variable life insurance allows you to invest your cash value in various investment options, offering the potential for higher returns but also higher risks compared to term life insurance.

Premiums and Cost

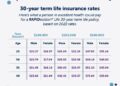

Term life insurance premiums are determined based on several factors. These factors include the insured individual's age, gender, overall health, lifestyle choices, coverage amount, and term length.

Calculation of Premiums

- Insurance companies use actuarial tables to assess the risk associated with insuring an individual.

- The younger and healthier the insured individual, the lower the premium is likely to be.

- Higher coverage amounts and longer terms generally result in higher premiums.

Factors Influencing Cost

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Health: Individuals with pre-existing medical conditions may face higher premiums.

- Smoking: Smokers usually pay higher premiums due to the associated health risks.

- Occupation and hobbies: Risky occupations or hobbies can increase premiums.

Tips to Reduce Premiums

- Maintain a healthy lifestyle by exercising regularly and eating well to potentially lower premiums.

- Quit smoking to reduce the cost of insurance.

- Compare quotes from multiple insurance companies to find the best rates.

- Consider term length carefully to ensure you are not paying for coverage you do not need.

Renewability and Convertibility

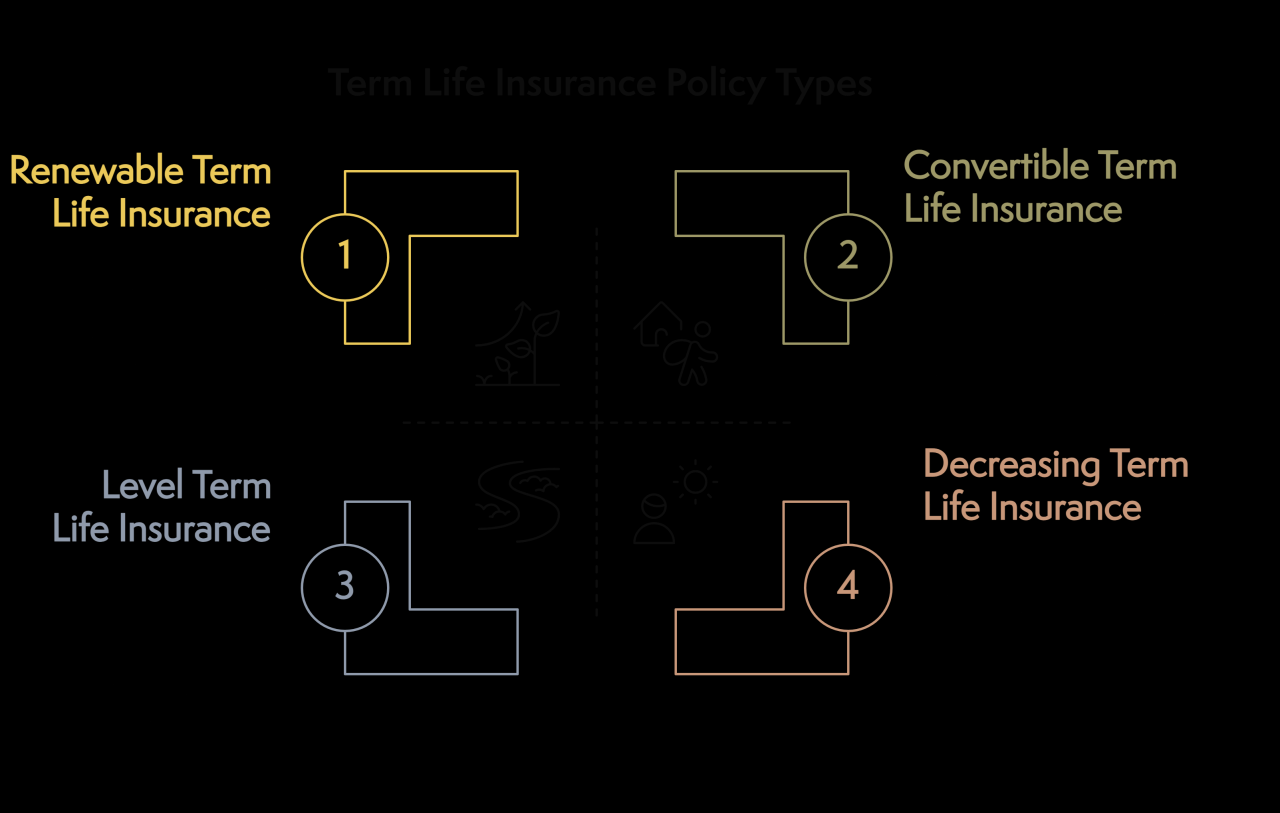

When considering a term life insurance policy, it's essential to understand the concepts of renewability and convertibility. These features can significantly impact the flexibility and long-term value of your policy.

Renewability Options

Renewability in term life insurance refers to the ability to renew your policy for an additional term once the initial term expires. There are typically two types of renewability options:

- Guaranteed Renewability: This allows you to renew your policy without undergoing a medical exam or providing evidence of insurability. The premium may increase with each renewal.

- Non-Guaranteed Renewability: With this option, the insurance company has the discretion to renew your policy or not. They may require a medical exam or reassessment of your health status, which can lead to higher premiums.

Convertibility Meaning

Convertibility is a feature that allows you to convert your term life insurance policy into a permanent life insurance policy, such as whole life or universal life, without the need for a medical exam. This can be beneficial if your insurance needs change, or if you want to secure coverage for the long term.

Importance of Renewability and Convertibility

It's crucial to consider renewability and convertibility when choosing a term life insurance policy. These features offer flexibility and the ability to adapt to your changing needs over time. By having the option to renew your policy or convert it to permanent coverage, you can ensure that you have the necessary protection in place as your life circumstances evolve.

Suitability and Considerations

When it comes to term life insurance, it is important to consider who it is most suitable for and what factors to keep in mind before purchasing a policy.

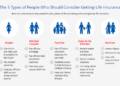

Who is Term Life Insurance Most Suitable For?

- Term life insurance is ideal for individuals who have financial dependents and want to ensure their loved ones are protected in case of their untimely death.

- Young adults who are starting a family or have significant financial obligations, such as a mortgage, may find term life insurance beneficial.

- Those looking for an affordable way to obtain a high coverage amount for a specific period may also consider term life insurance.

Important Considerations When Purchasing Term Life Insurance

- Consider your financial obligations and the needs of your dependents to determine the appropriate coverage amount.

- Compare quotes from different insurance providers to find the best rates and coverage options that align with your needs.

- Review the policy terms, including the duration of coverage, premium payments, and any exclusions or limitations.

- Take into account any potential future changes in your financial situation, such as marriage, children, or career advancements, when selecting a policy.

Tips for Determining the Appropriate Coverage Amount

- Calculate your current financial obligations, including outstanding debts, mortgage payments, and future expenses like college tuition for children.

- Consider your family's lifestyle and future financial goals to ensure they are adequately provided for in the event of your passing.

- Factor in inflation and any potential increase in living expenses over the term of the policy to maintain sufficient coverage.

Closure

In conclusion, term life insurance emerges as a pragmatic choice for those looking to safeguard their family's financial well-being in times of uncertainty. Armed with knowledge from this guide, you're better equipped to make informed decisions regarding your insurance needs.

Quick FAQs

Is term life insurance the same as whole life insurance?

No, term life insurance provides coverage for a specific term, while whole life insurance covers you for your entire life.

Can I renew my term life insurance policy?

Yes, most term life insurance policies offer the option to renew at the end of the term.

What factors can affect the cost of term life insurance premiums?

Factors like age, health, coverage amount, and term length can influence the cost of term life insurance premiums.