Beginning with car insurance estimates, we delve into the various factors that influence these estimates, how to obtain accurate quotes, the types of coverage impacting estimates, and ways to lower them. This comprehensive guide aims to provide valuable insights into the world of car insurance estimates.

Factors influencing car insurance estimates

When it comes to determining car insurance estimates, several key factors play a significant role in shaping the final cost. Understanding these factors can help individuals make informed decisions when selecting the right insurance plan for their needs.

Type of car

The type of car you drive can have a substantial impact on your insurance estimates. Generally, high-performance vehicles or luxury cars tend to have higher insurance costs due to their increased risk of theft or accidents. On the other hand, economical and safe cars typically come with lower insurance premiums.

Driver’s age

Age is another crucial factor that insurance companies consider when calculating estimates. Younger drivers, especially those under 25, often face higher insurance costs due to their lack of driving experience and statistically higher likelihood of being involved in accidents. Older, more experienced drivers typically enjoy lower insurance premiums.

Driving record

Your driving record, including any past accidents or traffic violations, can significantly impact your insurance quotes. Drivers with a history of accidents or speeding tickets are viewed as higher risks by insurance companies and may face increased premiums. Conversely, individuals with clean driving records are likely to receive lower insurance estimates.

Other factors

In addition to the type of car, driver's age, and driving record, several other factors can influence car insurance estimates. These may include the location where the car is primarily driven, the frequency of use, the purpose of the vehicle (personal or business), and even the driver's credit history.

By considering all these factors, individuals can better understand why their insurance estimates vary and take steps to potentially lower their costs.

How to obtain accurate car insurance estimates

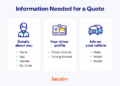

When looking to get an accurate car insurance estimate, it's essential to provide the necessary information to insurance providers. This includes details about your vehicle, driving history, and coverage preferences. By understanding what factors influence insurance costs and comparing quotes from different providers, you can ensure you're getting the most accurate estimate for your needs.

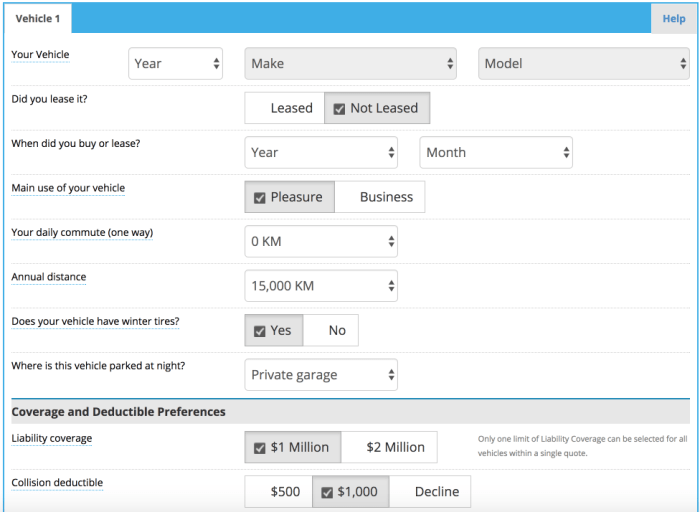

Information needed for precise insurance estimates

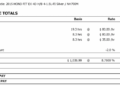

- Details about your vehicle, including make, model, year, and mileage.

- Your driving history, including any accidents or traffic violations.

- Information about additional drivers who will be covered under the policy.

- Your desired coverage options, such as liability, comprehensive, collision, and personal injury protection.

Tips for comparing quotes

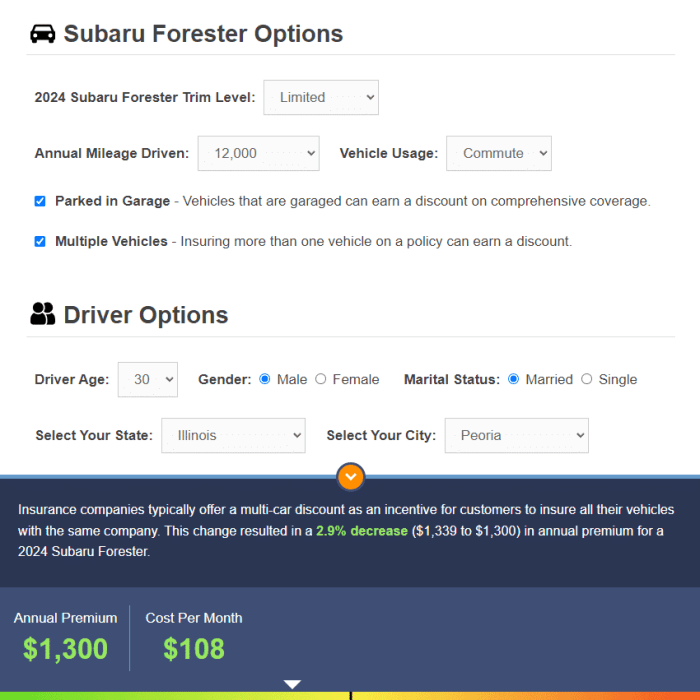

- Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Consider bundling your car insurance with other policies, such as home or renters insurance, for potential discounts.

- Look for discounts based on factors like safe driving habits, vehicle safety features, and annual mileage.

Importance of understanding coverage options

- Understanding the different coverage options available can help you choose the right policy for your needs.

- Make sure to review the limits and deductibles for each coverage type to ensure you have adequate protection.

- Consider factors like the age and value of your vehicle when selecting coverage options to avoid overpaying for unnecessary protection.

Online tools for estimating car insurance costs

- Insurance company websites often provide online calculators to help you estimate your insurance costs based on the information you provide.

- Third-party websites may offer comparison tools that allow you to see quotes from multiple providers side by side.

- Consider using apps or tools that track your driving habits to potentially lower your insurance costs based on safe driving behavior.

Types of coverage impacting car insurance estimates

When it comes to car insurance estimates, the type of coverage you choose plays a significant role in determining the cost. Understanding the differences between liability, comprehensive, and collision coverage, as well as the impact of adding extras like roadside assistance, can help you make informed decisions.

Liability Coverage

Liability coverage is mandatory in most states and covers damages you cause to others in an accident

Choosing lower liability limits can reduce your insurance premium, but it may leave you exposed to higher out-of-pocket costs in the event of a claim.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, and natural disasters. While it provides broader coverage, adding comprehensive coverage to your policy can increase your insurance premium. However, if you have a newer or more valuable car, comprehensive coverage can offer valuable protection.

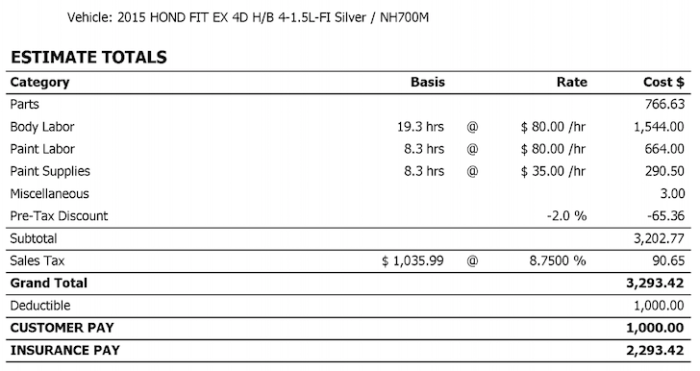

Collision Coverage

Collision coverage pays for damage to your vehicle in the event of a collision with another vehicle or object. Adding collision coverage to your policy can increase your insurance premium, especially if you have a history of accidents or drive a high-value vehicle.

It provides peace of mind knowing that your car repairs will be covered in case of an accident.

Roadside Assistance

Roadside assistance is an optional extra that can be added to your policy for an additional cost. It provides services like towing, battery jumps, and flat tire changes in case of a breakdown. While adding roadside assistance can increase your insurance premium slightly, it can offer valuable support in emergencies and give you peace of mind on the road.In summary, the type of coverage you choose for your car insurance policy can have a significant impact on your insurance estimates.

Understanding the differences between liability, comprehensive, and collision coverage, as well as the benefits of adding extras like roadside assistance, can help you tailor your policy to meet your needs and budget effectively.

Ways to lower car insurance estimates

Lowering car insurance estimates can help you save money while still ensuring you have the coverage you need. Here are some effective strategies to reduce your insurance costs:

Bundling Policies

One way to lower your car insurance estimate is by bundling multiple insurance policies with the same company. This could include combining your auto insurance with your homeowner's or renter's insurance. Insurance companies often offer discounts for bundling policies, resulting in overall savings on your premiums.

Improving Driving Habits

Another way to qualify for lower car insurance premiums is by improving your driving habits. Safe driving practices such as avoiding speeding tickets and accidents can help you qualify for discounts with many insurance companies. Some insurers even offer usage-based programs that track your driving behavior and adjust your rates accordingly.

Increasing Deductibles

Increasing your deductibles can also lower your car insurance estimates. By opting for a higher deductible, you are agreeing to pay more out of pocket in the event of a claim, which can result in lower monthly premiums. However, it's important to make sure you can afford the higher deductible if you do need to file a claim.

Discounts Offered by Insurance Companies

Insurance companies often provide a variety of discounts that can help lower your car insurance estimate. These discounts may be based on factors such as your driving record, the safety features of your vehicle, or even your age or occupation.

Some common discounts include safe driver discounts, multi-vehicle discounts, and discounts for completing driver training courses.

Conclusion

In conclusion, understanding the intricacies of car insurance estimates is essential for making informed decisions. By considering the factors, accuracy, coverage types, and strategies to lower costs, you can navigate the realm of car insurance with confidence and financial prudence.

Key Questions Answered

How does the type of car affect insurance estimates?

The type of car, including its make, model, and age, can impact insurance estimates. Generally, luxury or sports cars have higher premiums due to repair costs and theft risks.

What information is needed to get a precise insurance estimate?

To obtain an accurate quote, you typically need details about your driving history, the vehicle you wish to insure, your location, and the coverage options you're interested in.

What is the difference between liability, comprehensive, and collision coverage?

Liability covers damages to others, while comprehensive and collision cover damages to your vehicle. Each type of coverage impacts insurance estimates differently based on the level of protection offered.

How can I lower my car insurance estimates?

You can lower insurance costs by bundling policies, improving driving habits to qualify for discounts, and considering increasing deductibles. Insurance companies also offer various discounts that can help reduce estimates.