Home insurance quote is more than just a piece of paper; it's your shield against unexpected events that could disrupt your life. In this detailed guide, we delve into the intricacies of home insurance quotes, shedding light on key factors and essential information to help you make informed decisions.

As we navigate through the different types of coverage, factors affecting quotes, and the process of obtaining a quote, you'll gain valuable insights into securing the right protection for your home.

Understanding Home Insurance Quote

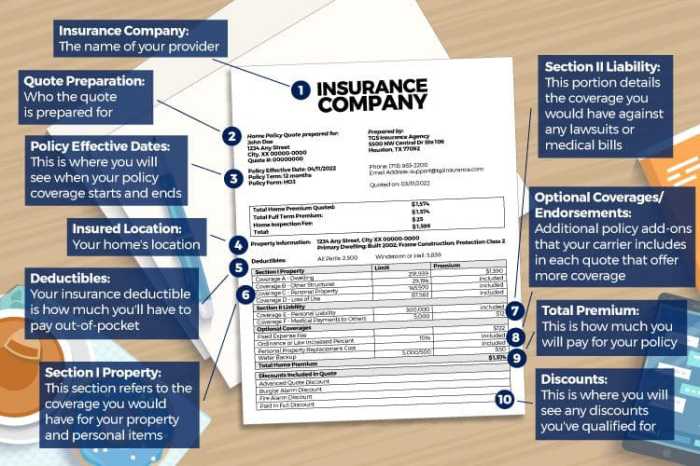

When it comes to protecting your home, getting a home insurance quote is a crucial step in ensuring you have the right coverage in place. A home insurance quote is an estimate of how much it would cost to insure your home based on various factors such as the value of your home, its location, and the coverage options you choose.

Importance of Getting a Home Insurance Quote

Obtaining a home insurance quote is essential for several reasons:

- Helps you understand the cost of insuring your home and belongings.

- Allows you to compare different insurance options and select the best coverage for your needs.

- Provides financial protection in case of unforeseen events like natural disasters, theft, or accidents.

Key Factors that Influence Home Insurance Quotes

Several factors can affect the cost of your home insurance quote:

- The value and age of your home.

- The location of your home, including its proximity to fire stations, crime rates, and weather patterns.

- The coverage options you choose, such as liability coverage or additional endorsements for valuable items.

- Your claims history and credit score.

Types of Home Insurance Coverage

When it comes to home insurance, there are different types of coverage available to protect your property and belongings. Understanding the various types of home insurance coverage is crucial in ensuring that you have the right protection for your individual needs.

HO-1: Basic Form

The HO-1 policy is a basic form of home insurance coverage that typically covers damages caused by specific perils such as fire, lightning, windstorm, hail, theft, vandalism, and more. It is a limited form of coverage compared to other options.

HO-2: Broad Form

HO-2 provides more comprehensive coverage than HO-1, offering protection against a broader range of perils. This type of policy usually covers the structure of your home and personal belongings against specified risks.

HO-3: Special Form

HO-3 is the most common type of home insurance policy and provides coverage for your home's structure against all perils unless they are specifically excluded. It also includes coverage for personal belongings and liability protection.

Examples of Coverage Options

- Property Coverage: Protects your home and other structures on your property.

- Personal Property Coverage: Covers your belongings inside the home.

- Liability Coverage: Protects you in case someone is injured on your property.

- Additional Living Expenses: Covers the cost of living elsewhere if you cannot stay in your home due to damage.

Significance of Choosing the Right Coverage

Choosing the right home insurance coverage is essential to ensure that you are adequately protected in case of unforeseen events. By understanding the different types of coverage and selecting the one that best suits your needs, you can have peace of mind knowing that your home and belongings are safeguarded.

Factors Affecting Home Insurance Quotes

When it comes to calculating home insurance quotes, there are several factors that insurance companies take into consideration. These factors can significantly impact the premiums homeowners pay for their coverage. Let's explore some of the common factors that affect home insurance quotes

Location

The location of your home plays a crucial role in determining your insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered high-risk and may result in higher premiums. Additionally, the proximity to fire stations, crime rates, and historical weather patterns in your area can also influence the cost of your home insurance.

Home Value

The value of your home is another key factor that insurance companies look at when calculating your insurance quote. The higher the value of your home, the more it will cost to repair or replace in case of damage or loss.

Therefore, homes with higher values typically have higher insurance premiums.

Claim History

Your claim history also plays a significant role in determining your insurance premium. If you have a history of filing multiple claims, insurance companies may see you as a higher risk and charge you more for coverage. On the other hand, homeowners with a clean claims history are often rewarded with lower premiums.

Ways to Lower Insurance Quotes

There are a few strategies homeowners can implement to potentially lower their insurance quotes. One way is to increase your home's security by installing alarm systems, deadbolts, or smoke detectors. Another way is to bundle your home insurance with other policies such as auto insurance to qualify for discounts.

Additionally, maintaining a good credit score and shopping around for quotes from different insurance providers can also help you find more affordable coverage options.

Obtaining a Home Insurance Quote

When it comes to obtaining a home insurance quote, there are several key steps to keep in mind to ensure you get the right coverage at the best price possible.

Estimating Coverage Needs

- Assess the value of your home and belongings accurately to determine the coverage needed.

- Consider potential risks in your area such as natural disasters or crime rates.

- Factor in additional coverage options like liability insurance or coverage for high-value items.

Methods of Obtaining Quotes

- Online:Many insurance companies offer online tools to generate quick quotes based on the information you provide.

- Through Agents:Working with an insurance agent can help you navigate the process and ensure you get personalized recommendations.

- Comparison Websites:Websites that allow you to compare quotes from multiple insurers can help you find the best deal.

Summary

In conclusion, understanding the nuances of home insurance quotes empowers you to safeguard your most valuable asset with confidence. By grasping the intricacies of coverage options and factors influencing quotes, you're better equipped to make informed choices that cater to your individual needs.

FAQ

What factors can impact my home insurance quote?

Factors such as the location of your home, its value, and your claim history can influence the cost of your insurance premium.

How can I lower my home insurance quote?

Homeowners can potentially lower their insurance quotes by increasing home security measures, bundling policies, and maintaining a good credit score.

What types of coverage are typically included in a standard home insurance policy?

A standard home insurance policy usually includes coverage for dwelling, personal property, liability, and additional living expenses.