Delving into the realm of auto insurance near me, this introductory paragraph aims to pique the interest of readers with valuable insights and information.

Providing a detailed overview of the topic, this paragraph sets the stage for what's to come in the subsequent sections.

Research

When it comes to auto insurance, conducting thorough research is essential to ensure you have the right coverage for your needs. Understanding the importance of having auto insurance and the different types of coverage available can help you make informed decisions.

Additionally, comparing local and national auto insurance companies can help you choose the best option for your specific situation.

Importance of Having Auto Insurance

Having auto insurance is crucial to protect yourself, your passengers, and your vehicle in case of an accident. It provides financial coverage for medical expenses, vehicle repairs, and legal fees that may result from a collision. Without auto insurance, you could be held personally liable for these costs, putting your financial security at risk.

Types of Auto Insurance Coverage

- Liability Coverage: Covers damages and injuries you cause to others in an accident.

- Collision Coverage: Pays for repairs to your vehicle after a collision.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft or vandalism.

- Uninsured/Underinsured Motorist Coverage: Covers you if you're in an accident with a driver who has insufficient insurance.

Local vs. National Auto Insurance Companies

Local auto insurance companies may offer personalized service and knowledge of the area, while national companies often have more resources and potentially lower rates. Consider factors like customer service, coverage options, and pricing when deciding between a local or national insurer.

Finding Local Providers

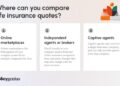

When searching for "auto insurance near me," it's essential to follow a step-by-step guide to ensure you find the best local providers in your area. Here's how you can do it:

Step-by-Step Guide

- Start by using a search engine to look up "auto insurance near me" or similar s.

- Check out the top results to see which local providers are listed.

- Visit the websites of these providers to gather information about their services, coverage options, and customer reviews.

- Contact the insurance agencies directly to ask for quotes and additional details about their policies.

- Compare the offers from different local providers to determine which one best suits your needs and budget.

Advantages of Local Providers

Local auto insurance providers offer several advantages, including:

- Personalized service: Local agents can provide personalized assistance and recommendations based on your specific needs.

- Convenience: Easy access to a physical location for in-person interactions and support.

- Community support: Supporting local businesses helps boost the local economy and fosters a sense of community.

Tips for Evaluating Reliability

When evaluating the reliability of local auto insurance agencies, consider the following tips:

- Check for licenses and certifications: Ensure that the agency is licensed to sell insurance in your state and holds relevant certifications.

- Read reviews and testimonials: Look for feedback from previous customers to gauge the quality of service provided by the agency.

- Ask about claims processing: Inquire about the agency's process for handling claims and how quickly they can assist you in case of an accident.

- Compare coverage options: Make sure to compare the coverage options offered by different local providers to find the best policy for your needs.

Coverage Options

When it comes to auto insurance coverage options offered by companies near you, there are several common choices to consider

Liability Coverage

Liability coverage is typically required by law and helps cover costs if you're responsible for injuring someone else or damaging their property in an accident.

Collision Coverage

Collision coverage helps pay for repairs to your own vehicle in the event of a collision with another car or object.

Comprehensive Coverage

Comprehensive coverage helps cover damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist Coverage

This coverage can help protect you if you're in an accident with a driver who doesn't have insurance or enough insurance to cover your expenses.

Personal Injury Protection (PIP)

PIP coverage can help cover medical expenses for you and your passengers after an accident, regardless of who was at fault.

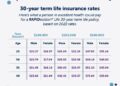

Factors Affecting Cost

Several factors can influence the cost of your auto insurance coverage. These may include your driving record, age, location, type of vehicle, coverage limits, and deductible amount. Additionally, discounts for things like bundling policies or having a good driving record can help lower your premium.

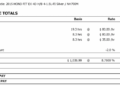

Comparison of Coverage

When comparing coverage options from multiple local auto insurance providers, it's important to consider not only the cost but also the specific coverage limits, deductibles, and additional benefits offered by each company. Be sure to review the details of each policy to determine which one best fits your needs and budget.

Customer Reviews

Checking customer reviews before choosing an auto insurance provider is crucial to ensure you are making an informed decision. These reviews can provide valuable insights into the quality of service, claims processing, and overall customer satisfaction.

Evaluating Online Reviews

- Look for patterns: Pay attention to recurring themes in the reviews, such as excellent customer service or delayed claim processing.

- Consider the source: Check if the reviews are from verified customers or if they seem biased or fake.

- Read both positive and negative reviews: Get a balanced view of the company's strengths and weaknesses.

- Take overall ratings into account: Look at the overall rating of the company based on customer reviews.

Significance of Customer Feedback

- Helps in decision-making: Customer reviews can help you weigh the pros and cons of different auto insurance providers.

- Provides real-life experiences: By reading reviews, you can get a glimpse of what it's like to be a customer of a particular company.

- Improves transparency: Companies value customer feedback and use it to enhance their services and address any issues.

Last Point

Wrapping up our discussion on auto insurance near me, this concluding paragraph offers a concise summary of the key points discussed, leaving readers with a lasting impression.

User Queries

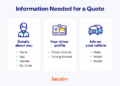

What are the key factors to consider when choosing auto insurance near me?

When selecting auto insurance near you, it's essential to assess the coverage options, compare prices, evaluate customer reviews, and consider the reliability of the insurance provider.

Is it better to opt for a local or national auto insurance company?

Local providers often offer personalized service and a better understanding of local regulations, while national companies may provide more extensive coverage options and resources.

How can I determine the most suitable coverage options for my auto insurance needs?

To find the right coverage for your needs, assess factors like your vehicle type, driving habits, budget, and any specific requirements you may have, consulting with insurance agents for guidance if needed.

What role do customer reviews play in selecting an auto insurance provider near me?

Customer reviews offer valuable insights into the experiences of others with the insurance company, helping you gauge their reliability, customer service, and overall satisfaction levels.