Diving into the realm of homeowners insurance, this introduction sets the stage for an insightful discussion on finding the best coverage for your home. From understanding the purpose of insurance to navigating various coverage options, this overview aims to equip readers with valuable insights and considerations.

In the subsequent paragraph, detailed information will be provided to shed light on the intricacies of homeowners insurance and how to make well-informed decisions.

Introduction to Homeowners Insurance

Homeowners insurance is a type of property insurance that provides financial protection against damages to one's home and personal belongings. It also offers liability coverage in case someone is injured on the property.

Purpose of Homeowners Insurance

- Protecting Your Home: Homeowners insurance safeguards your home from unforeseen events such as fire, theft, vandalism, or natural disasters like hurricanes or earthquakes.

- Personal Property Coverage: It helps replace or repair personal belongings such as furniture, appliances, and clothing that are damaged or stolen.

- Liability Protection: Homeowners insurance covers legal expenses if someone is injured on your property and decides to sue you for damages.

Importance of Having Homeowners Insurance

- Financial Security: In the event of a disaster, homeowners insurance provides financial protection to repair or rebuild your home and replace belongings.

- Mortgage Requirement: Most mortgage lenders require homeowners insurance to protect their investment in case of property damage.

- Peace of Mind: Knowing that you are covered by homeowners insurance can give you peace of mind and reduce stress in times of crisis.

Key Components Covered by Homeowners Insurance Policies

- Dwelling Coverage: Protects the physical structure of your home, including walls, roof, and foundation.

- Personal Property Coverage: Covers personal belongings like furniture, clothing, and electronics.

- Liability Coverage: Offers financial protection if someone is injured on your property and you are found liable.

- Additional Living Expenses: Pays for temporary living arrangements if your home is uninhabitable due to a covered loss.

Factors to Consider When Choosing the Best Homeowners Insurance

When selecting the best homeowners insurance policy, there are several key factors to take into consideration to ensure you have the right coverage for your needs. Let's explore some of the most important factors below.

Importance of Coverage Limits and Deductibles

When choosing a homeowners insurance policy, it is crucial to pay attention to the coverage limits and deductibles. Coverage limits determine the maximum amount your insurance company will pay for a covered loss, while deductibles are the amount you are responsible for paying out of pocket before your insurance kicks in.

It's essential to strike a balance between affordable premiums and adequate coverage limits to protect your home and belongings effectively.

Types of Coverage Options Available

There are different types of coverage options available in homeowners insurance policies, including dwelling coverage (to protect the structure of your home), personal property coverage (for your belongings), and liability coverage (to protect you in case someone is injured on your property).

Understanding these coverage options and choosing the right combination based on your needs is essential for comprehensive protection.

Impact of Location and Property Value on Insurance Premiums

The location of your home and its property value can significantly impact your insurance premiums. Homes located in areas prone to natural disasters or with high crime rates may have higher premiums. Additionally, the value of your property and the cost to rebuild or repair your home in case of damage will influence your insurance costs.

It's essential to consider these factors when selecting a homeowners insurance policy to ensure you are adequately protected.

Top Companies Offering Homeowners Insurance

When it comes to choosing the best homeowners insurance, it's essential to consider reputable insurance companies known for providing reliable coverage and excellent customer service. Let's take a look at some of the top companies in the industry and compare their reputation, customer satisfaction ratings, and unique features.

Allstate

Allstate is a well-known insurance company offering homeowners insurance with a strong reputation for reliable coverage and excellent customer service. They provide a range of coverage options to protect your home and belongings, along with discounts for bundling policies. Allstate is highly rated for customer satisfaction and offers helpful online tools for policy management.

State Farm

State Farm is another top insurance company that offers homeowners insurance with a focus on personalized service and comprehensive coverage options. They have a strong financial stability rating and a long history of serving policyholders. State Farm also provides discounts for home safety features and multi-policy bundles, making it a popular choice among homeowners.

Amica Mutual

Amica Mutual is known for its exceptional customer service and high customer satisfaction ratings. They offer customizable homeowners insurance policies with options for additional coverage such as identity theft protection and valuable items coverage. Amica Mutual is a mutual insurance company, meaning policyholders are also part-owners, which can result in potential policyholder dividends.

Lemonade

Lemonade is a newer player in the insurance industry that offers homeowners insurance with a unique approach. They operate as a digital insurance company, utilizing AI technology to streamline the insurance process and provide quick claims processing. Lemonade is known for its transparent pricing and social impact initiatives, donating unclaimed premiums to charitable causes chosen by policyholders.

USAA

USAA is a highly rated insurance company that specializes in serving military members and their families. They offer homeowners insurance with competitive rates and excellent customer service tailored to the needs of military personnel. USAA provides coverage options for unique situations such as deployments and offers discounts for military members and their families.

Tips for Finding the Best Homeowners Insurance Policy

![Top 10 Best Home Insurance Companies Rates [The Truth] Top 10 Best Home Insurance Companies Rates [The Truth]](https://nz.aboutmalang.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates.png)

When it comes to choosing the best homeowners insurance policy, there are several important factors to consider. By following these tips, you can ensure that you find the right coverage for your needs at the best possible price.

Assessing Individual Insurance Needs

Before selecting a homeowners insurance policy, it's crucial to evaluate your individual insurance needs. Consider factors such as the value of your home, personal belongings, and any potential risks in your area. By understanding your specific requirements, you can choose a policy that provides adequate coverage.

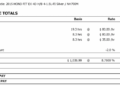

Obtaining Multiple Quotes

It's advisable to obtain quotes from multiple insurers when shopping for homeowners insurance. By comparing different offers, you can identify the most competitive rates and coverage options available. This allows you to make an informed decision based on your budget and insurance requirements.

Saving Money on Premiums

There are several strategies you can use to save money on homeowners insurance premiums. Consider bundling your home and auto insurance policies with the same insurer, installing safety features such as smoke alarms and security systems, and maintaining a good credit score.

Additionally, raising your deductible can lower your premium costs, but ensure you can afford the out-of-pocket expenses in case of a claim.

Concluding Remarks

Concluding our exploration of homeowners insurance, this summary encapsulates the key points discussed, emphasizing the importance of thorough research and comparison when selecting the best policy for your needs.

Detailed FAQs

What factors should I consider when choosing homeowners insurance?

Consider coverage limits, deductibles, and how location and property value impact premiums.

How can I find the best homeowners insurance policy?

Assess your individual insurance needs, obtain quotes from different insurers, and look for ways to save on premiums.

![Top 10 Best Home Insurance Companies Rates [The Truth]](https://nz.aboutmalang.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates-700x375.png)