When it comes to final expense insurance quotes, understanding the ins and outs can make a significant difference. From what it is to how to get the best deal, this comprehensive guide will shed light on all aspects of final expense insurance quotes.

So, let's dive in and explore the world of final expense insurance quotes together.

Exploring the process, benefits, and costs associated with final expense insurance quotes can help individuals and families make informed decisions for their future.

Understanding Final Expense Insurance

Final expense insurance is a type of insurance policy specifically designed to cover the costs associated with a person's funeral, burial, and other end-of-life expenses. The primary purpose of final expense insurance is to provide financial assistance to the policyholder's loved ones during a difficult time, ensuring that they are not burdened with the expenses of a funeral and other related costs.

Final expense insurance coverage typically includes benefits such as:

Examples of Final Expense Insurance Coverage

- Funeral expenses

- Burial costs

- Cremation expenses

- Medical bills

- Outstanding debts

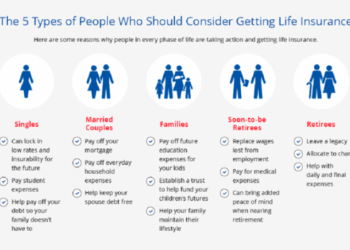

Having final expense insurance can be crucial for individuals and families as it helps alleviate the financial strain that can come with planning and paying for a funeral. It allows loved ones to focus on grieving and honoring the deceased without having to worry about the financial implications of end-of-life arrangements.

Getting a Quote for Final Expense Insurance

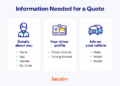

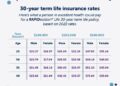

When it comes to final expense insurance, getting a quote is an important step in the process. This quote will give you an estimate of the cost and coverage options available to you based on your individual circumstances.Factors considered when determining a final expense insurance quote include:

- Your age: Younger individuals typically receive lower quotes compared to older individuals.

- Your health: Your current health status and any pre-existing conditions may impact the quote you receive.

- The coverage amount: The higher the coverage amount you choose, the higher your quote is likely to be.

- The type of policy: Different types of final expense insurance policies have varying costs and benefits.

Requesting and Comparing Quotes

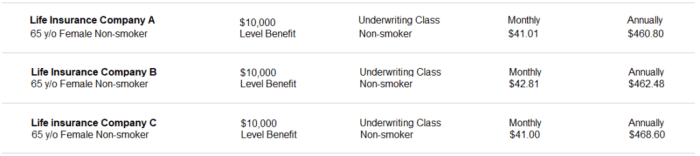

To request a final expense insurance quote, you can reach out to insurance providers directly or use online tools available on their websites. It's important to provide accurate information about your age, health, and coverage needs to receive an accurate quote.When comparing final expense insurance quotes from different providers, consider the coverage amount, premiums, policy features, and customer reviews.

Take the time to carefully review each quote to ensure you're getting the best value for your needs.

Benefits of Final Expense Insurance

Final expense insurance offers several benefits that can provide peace of mind and financial security for individuals and their loved ones. Unlike other types of insurance, final expense insurance is specifically designed to cover the costs associated with a person's funeral, burial, and other end-of-life expenses.

Here are some key advantages of having final expense insurance:

1. Coverage for Funeral Expenses

Final expense insurance ensures that your loved ones are not burdened with the high costs of a funeral and burial. This type of insurance typically covers expenses such as caskets, urns, memorial services, and cemetery plots.

2. No Medical Exam Required

Unlike traditional life insurance policies, final expense insurance often does not require a medical exam. This makes it easier for individuals with pre-existing health conditions to obtain coverage.

3. Fixed Premiums

Final expense insurance usually comes with fixed premiums that do not increase with age. This can provide predictability and stability in terms of financial planning for the insured and their beneficiaries.

4. Quick Payout

Final expense insurance policies typically pay out quickly, usually within days of the insured's passing. This can help cover immediate expenses and provide financial support to the family during a difficult time.

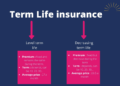

Comparison with Life Insurance

While life insurance provides a broader range of coverage and benefits, final expense insurance is more focused on covering end-of-life expenses specifically. Life insurance policies may have higher coverage amounts but can also be more expensive and require a medical exam.

Real-Life Scenarios

For example, a family that had final expense insurance for their elderly parent was able to cover all funeral expenses without dipping into their savings or taking on debt. This allowed them to focus on grieving and supporting each other without financial stress.

Cost and Affordability

When it comes to final expense insurance, the cost is a crucial factor to consider. The premiums for this type of insurance can vary based on several factors, including the insured individual's age, health status, coverage amount, and the insurance provider.

Cost Factors Associated with Final Expense Insurance

- The age of the insured: Generally, the older the individual, the higher the premiums.

- Health status: Pre-existing medical conditions may lead to higher premiums.

- Coverage amount: The higher the coverage amount, the higher the premiums.

- Insurance provider: Different insurance companies offer varying rates for final expense insurance.

Tips on Finding Affordable Final Expense Insurance Quotes

- Compare quotes from multiple insurance providers to find the best rate.

- Consider opting for a smaller coverage amount if you are looking to lower your premiums.

- Maintain a healthy lifestyle to potentially qualify for lower premiums.

- Work with an insurance agent who can help you navigate your options and find affordable coverage.

How to Budget for Final Expense Insurance Premiums

It's important to budget for your final expense insurance premiums to ensure that you can afford the coverage throughout your lifetime. Here are some tips:

- Include the premium amount in your monthly budget as a fixed expense.

- Consider setting up automatic payments to ensure you never miss a premium payment.

- Review your budget regularly to make adjustments if needed.

- Plan ahead for potential premium increases as you age.

Conclusion

In conclusion, final expense insurance quotes serve as a crucial financial tool for planning ahead and ensuring peace of mind for loved ones. By understanding the process, benefits, and costs, individuals can make well-informed choices when it comes to final expense insurance.

Empower yourself with knowledge and secure your financial future today.

Essential FAQs

What factors determine a final expense insurance quote?

Final expense insurance quotes are typically based on age, health status, coverage amount, and the chosen insurance provider. These factors play a significant role in determining the final quote.

Can final expense insurance be used to cover funeral costs?

Yes, one of the key purposes of final expense insurance is to cover end-of-life expenses, including funeral costs. It provides financial assistance to ease the burden on loved ones.

Is final expense insurance similar to life insurance?

While final expense insurance and life insurance both provide financial protection, final expense insurance is specifically designed to cover end-of-life expenses, whereas life insurance offers broader coverage.

How can individuals find affordable final expense insurance quotes?

To find affordable final expense insurance quotes, individuals can compare quotes from different providers, consider their coverage needs, and explore options for customization based on their budget.

What are the benefits of having final expense insurance?

Having final expense insurance provides peace of mind by ensuring that end-of-life expenses are covered, relieving financial stress on loved ones. It also allows individuals to plan ahead and protect their legacy.