Delving into the realm of Business Insurance, this piece unveils the importance, types, factors to consider, costs, claims process, and regulations surrounding this vital aspect of company operations. Brace yourself for a journey filled with valuable insights and practical tips.

Importance of Business Insurance

Business insurance is a crucial aspect for companies of all sizes as it provides protection and financial security in the face of unexpected events. It helps businesses mitigate risks and recover from potential losses that could otherwise lead to financial ruin.

Types of Risks Covered by Business Insurance

- Property Damage: Business insurance can cover damages to physical assets such as buildings, equipment, and inventory due to events like fires, storms, or theft.

- Liability Claims: In case of accidents or injuries on business premises, liability insurance can protect the company from legal claims and medical expenses.

- Business Interruption: If a disaster or unforeseen event disrupts business operations, insurance can cover lost income, rent, and other expenses until normal operations resume.

Benefits of Having Business Insurance

- Financial Protection: Business insurance provides a safety net to cover costs associated with unexpected events, preventing financial strain on the company.

- Legal Compliance: Some types of business insurance, such as workers' compensation, are required by law, ensuring compliance and avoiding penalties.

- Reputation Management: By having insurance, a company demonstrates its commitment to protecting its assets, employees, and clients, enhancing its reputation in the industry.

Types of Business Insurance Coverage

Business insurance coverage is essential for protecting your company from various risks and liabilities. There are different types of insurance policies available, each offering unique coverage tailored to specific needs.

General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. This type of insurance is crucial for businesses that interact with customers, vendors, or clients.

- Example Scenario: A customer slips and falls in your store, sustaining injuries. General liability insurance would cover the medical expenses and legal fees associated with the incident.

Property Insurance

Property insurance protects your business assets, including buildings, equipment, inventory, and furniture, from damage or loss due to events like fire, theft, vandalism, or natural disasters.

- Example Scenario: A fire breaks out in your office, causing significant damage to your equipment and inventory. Property insurance would cover the cost of repairs or replacement of the damaged items.

Workers’ Compensation Insurance

Workers' compensation insurance provides coverage for employees who suffer work-related injuries or illnesses. It helps cover medical expenses, lost wages, and rehabilitation costs for injured employees.

- Example Scenario: An employee injures their back while lifting heavy boxes at work. Workers' compensation insurance would cover their medical treatment, rehabilitation, and lost wages during recovery.

Factors to Consider When Choosing Business Insurance

When selecting insurance coverage for your business, there are several key factors to consider to ensure you have adequate protection in place.

Assessing Business Risks

- Identify potential risks specific to your industry and business operations.

- Consider the likelihood and potential impact of each risk on your business.

- Assess the financial consequences of not having adequate insurance coverage in place.

Determining Coverage Limits

- Evaluate the value of your business assets, including property, equipment, and inventory.

- Consider the potential costs of legal claims, lawsuits, or liability issues that could arise.

- Consult with insurance professionals to determine appropriate coverage limits for each type of insurance.

Cost of Business Insurance

When it comes to business insurance, the cost is a crucial factor that every business owner must consider. Understanding how insurance premiums are calculated, the factors that influence the cost, and strategies to potentially lower insurance costs can help businesses make informed decisions.

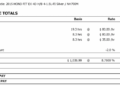

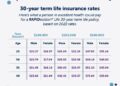

Insurance Premium Calculation

Insurance premiums for business insurance are calculated based on various factors, including the type of coverage needed, the size of the business, the industry in which the business operates, the location of the business, the claims history of the business, and the level of risk associated with the business.

Factors Influencing Insurance Cost

- The type of coverage required: Different types of coverage come with varying costs.

- Business size and industry: Larger businesses or those in high-risk industries may face higher premiums.

- Location: Businesses located in areas prone to natural disasters or high crime rates may have higher insurance costs.

- Claims history: A history of frequent or costly claims can lead to increased premiums.

- Level of risk: Businesses with higher risk factors, such as a hazardous work environment, may face higher insurance costs.

Strategies to Lower Insurance Costs

- Bundle policies: Combining multiple insurance policies with the same provider can often lead to discounts.

- Implement risk management practices: Taking steps to reduce risks within the business can lead to lower insurance costs.

- Shop around: Comparing quotes from different insurance providers can help businesses find the most affordable options.

- Consider a higher deductible: Opting for a higher deductible can lower monthly premiums, but businesses must be prepared to cover a larger portion of the cost in the event of a claim.

Claims Process for Business Insurance

When it comes to filing a business insurance claim, there are several typical steps that need to be followed. This process is essential for businesses to receive compensation for any covered losses or damages. Understanding how to navigate the claims process can help expedite the resolution and ensure a smooth experience for business owners.

Typical Steps in Filing a Business Insurance Claim

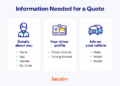

- Contact your insurance provider as soon as possible after the incident to report the claim.

- Provide all necessary documentation, such as photos, receipts, and any other relevant evidence to support your claim.

- Work with the insurance adjuster to assess the damage and determine the coverage and compensation amount.

- Review and sign any necessary paperwork to finalize the claim and receive your payout.

Expedite the Claims Process

- Respond promptly to any requests or inquiries from your insurance provider to avoid delays in processing your claim.

- Keep detailed records of all communications and documents related to your claim to ensure accuracy and expedite the process.

- Follow up with your insurance adjuster regularly to stay informed about the progress of your claim and address any concerns promptly.

Maximizing Insurance Claim Payouts

- Review your insurance policy carefully to understand the coverage limits and exclusions that may impact your claim payout.

- Document all losses and damages thoroughly to ensure you receive compensation for everything covered under your policy.

- Consider hiring a public adjuster to help negotiate a fair settlement with your insurance provider and maximize your claim payout.

Business Insurance Regulations

Business insurance regulations are laws and guidelines set by governing bodies to ensure that companies have adequate insurance coverage to protect against potential risks and liabilities. Compliance with these regulations is crucial for businesses to operate legally and responsibly.

Regulatory Requirements

- Businesses may be required to have certain types of insurance coverage based on their industry, size, and location.

- Insurance regulations may vary by state or country, so it's essential for businesses to understand the specific requirements in their area.

- Companies may need to provide proof of insurance to obtain licenses, permits, or contracts.

Impact on Company Operations

- Compliance with insurance regulations can help businesses avoid legal penalties, fines, or even shutdowns for operating without proper insurance coverage.

- Having the right insurance in place can protect a company's assets, employees, and reputation, ensuring smooth operations and financial stability.

- Non-compliance with insurance regulations can lead to lawsuits, financial losses, and damage to a company's credibility.

Consequences of Non-Compliance

- Businesses that fail to meet insurance requirements may face fines, penalties, or legal actions from regulatory authorities.

- Without adequate insurance, companies risk significant financial losses in the event of accidents, lawsuits, or other unforeseen events.

- Non-compliance with insurance regulations can also result in a damaged reputation, loss of trust from customers, and difficulties in securing contracts or partnerships.

Closing Summary

In conclusion, Business Insurance serves as a crucial shield against unforeseen risks, offering companies the protection they need to thrive in an unpredictable business landscape. With the right coverage and understanding of regulations, businesses can safeguard their assets and future growth effectively.

Top FAQs

Why is business insurance important?

Business insurance is essential as it provides financial protection against unforeseen events such as lawsuits, property damage, and employee injuries.

What factors should businesses consider when choosing insurance coverage?

Businesses should consider factors like their industry, size, location, and specific risks they face to determine the most suitable coverage.

How are insurance premiums calculated for business insurance?

Insurance premiums are calculated based on factors like the type of coverage, business size, location, claims history, and industry risks.

What are the typical steps involved in filing a business insurance claim?

The typical steps include notifying the insurance company, documenting the incident, filing a claim form, and working with an adjuster to assess the damage.

How can businesses expedite the claims process for insurance?

Businesses can expedite the process by promptly reporting incidents, providing thorough documentation, and cooperating with the insurance company.